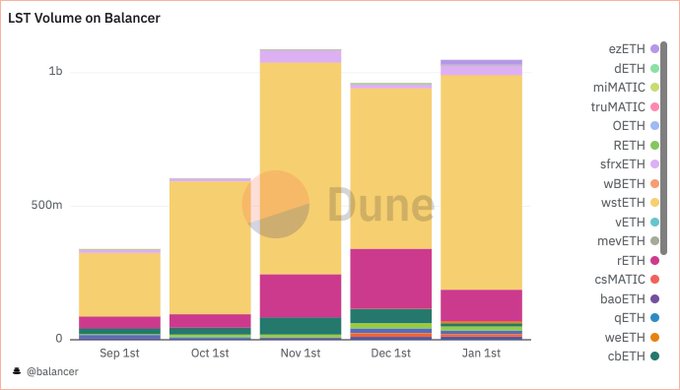

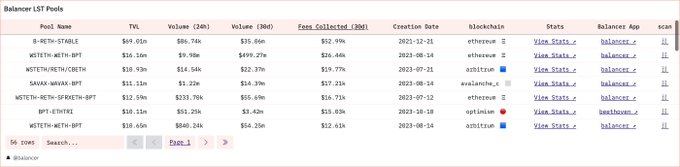

With over $330M in TVL and $8.6B in swap volume, Balancer has positioned itself as one of the top protocols for harnessing the power of Yield Bearing (YB) liquidity. The success is attributed to tailored-made technology, ecosystem integration, and incentive growth programs. Balancer's Composable Stable Pool (CSP) with an in-built Rate Provider ensures accurate yield-bearing token rates, minimizes risk, and optimizes capital efficiency. The protocol also emphasizes ecosystem integration and has collaborated with notable protocols to fuel the next wave of innovation. Balancer is becoming the hub for Liquid Restaking Tokens (LRTs), offering efficient hosting and growth of LRT liquidity.

1/ With @eigencloud points, restaking rewards, and supercharged Yield-Bearing efficiencies, the Liquid Restaking Wars are heating up! Here's what you need to know about the current liquidity leader ether.fi and $eETH. A 🧵

Balancer begins the journey to become the Hub for Liquid Restaking Tokens (LRTs). With technology tailored for yield-bearing assets, it just makes sense. @RenzoProtocol is the first LRT protocol to adopt Balancer Technology as its liquidity host and very likely not the last.

The Renzo ezETH/WETH liquidity pool is LIVE on @Balancer! 🚀 Swap or supply ezETH and enjoy: 1️⃣ 2x ezPoints boost on DEX LP 2️⃣ 1x ezPoints on deposits 3️⃣ 10% referral bonus ➕ EigenLayer points Restake ETH [Link in Bio] ☝🏼

With ~ $330M in LST TVL on the protocol, and over $8.6B in swap volume, Balancer has leveraged its flexibility as a DEX to establish itself as one of the leading protocols for harnessing the power of Yield Bearing (YB) liquidity. As the growth and adoption of LST/LRTs continue

Balancer continues to issue bi-weekly reports regarding the performance, sustainability, and success of the @arbitrum STIP Program. You can read the full report below or read on for the highlights. forum.arbitrum.foundation/t/balancer-sti… On January 11th, the TVL of Balancer was $135m, and

Plugging into YB native tech, core pool dynamics, and efficient @AuraFinance liquidity layers, protocols such as @ether_fi and @RenzoProtocol are fuelling a wave of LRT liquidity growth on Balancer! Why are Liquid Restaking Token protocols utilizing Balancer Tech to host their

We know you love $ETH Liquid Staked Tokens. And with over $321,000,000 LST TVL and $8,590,000,000 in swap volume, it's evident that many of you like to harness Balancer's Yield-Bearing native LST technology, too! @DuneAnalytics dune.com/balancer/lst

Balancer V3 Launches Three-Token Stablecoin Pool on Monad

Balancer V3 has deployed a three-token stablecoin pool on Monad, combining AUSD, USDC, and USDT0 in a single liquidity pool. **Key Features:** - First three-stablecoin pool enabled by Balancer V3 technology - Provides deep liquidity for AUSD stablecoin - Combines swap fees with lending yield for liquidity providers - Operates as both a stable and boosted pool The pool is now live and accessible at [balancer.fi](https://balancer.fi/pools/monad/v3/0x2daa146dfb7eaef0038f9f15b2ec1e4de003f72b). This deployment showcases V3's capability to handle multi-token stable pools, offering traders tighter spreads and liquidity providers additional yield opportunities beyond traditional two-token pairs.

Monad Enables Scalable Multi-Token Pools with Sub-Second Finality

**Monad's infrastructure breakthrough enables complex DeFi operations at scale.** The platform delivers: - **Sub-second finality** for near-instant transaction confirmation - **Parallel execution** allowing multiple operations simultaneously - **Cost-efficient multi-token pools** that remain practical at scale This technical foundation removes the latency and cost barriers that previously made complex pool operations inefficient on other chains. The infrastructure is purpose-built to support ambitious DeFi protocols requiring high throughput and low costs. Monad's approach addresses a core challenge in decentralized finance: maintaining performance as complexity increases.

Neverland Money Enables Dual-Yield Stablecoin Pool with Active Lending Deployment

A new liquidity pool integrates wrapped tokens from Neverland Money, allowing stablecoins to simultaneously generate lending yields while remaining available for trading. **How it works:** - Deposited stablecoins are actively deployed to lending protocols - Assets remain liquid and available for swaps at all times - When trades occur, the pool withdraws necessary amounts and redeploys excess capital **Yield sources:** - Swap fees from trading activity - Lending yields across all three pool assets This approach addresses a common DeFi tradeoff by enabling liquidity providers to earn from both trading fees and lending markets without sacrificing capital efficiency.

Stable Pools Optimize Trading for Assets Near Parity

**Stable Pools** are designed specifically for assets that trade close to equal value, like stablecoins pegged to the same dollar amount. **How it works:** - StableSwap math concentrates liquidity where trading actually occurs - Three stablecoins tracking the same value can trade with minimal slippage - Handles correlated assets (stablecoins and liquid staking tokens) with tight spreads **The advantage:** Assets that should trade near parity get the liquidity depth they need, without gas costs limiting activity. This represents genuine capital efficiency - liquidity is positioned exactly where it's most useful for traders. The approach benefits both liquidity providers and traders by reducing wasted capital on price ranges that rarely see activity.

🪙 Agora's AUSD Stablecoin Joins Major Stable Pool

**AUSD enters multi-stablecoin pool** Agora's AUSD stablecoin, with a $200M market cap and reserves managed by VanEck, has been combined into a stable pool alongside USDC and USDT. - AUSD: Fully-backed stablecoin by Agora - USDC: Backed by Circle - USDT: Backed by Tether The three major stablecoins are now pooled together, creating a unified liquidity solution. This follows AUSD's previous expansion across multiple blockchain networks including Plasma, Berachain, Citrea, Initia, and Sei Network.