Balancer Becomes Focal Hub for Liquid Restaking Token Liquidity

Balancer Becomes Focal Hub for Liquid Restaking Token Liquidity

🔥 Liquid Restaking Frenzy

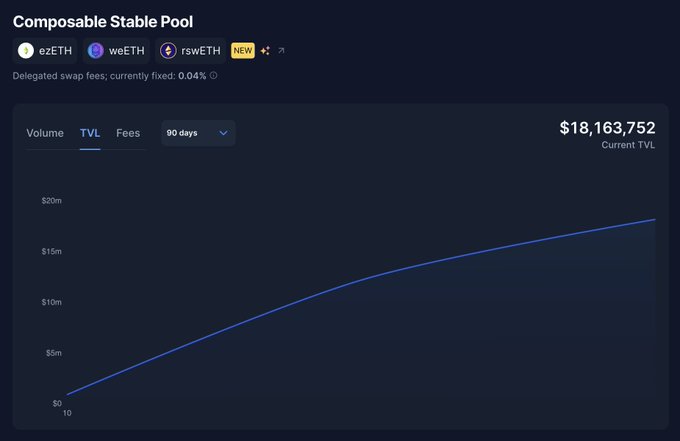

Balancer, a decentralized exchange protocol, has emerged as a leading platform for hosting liquidity for Liquid Restaking Tokens (LRTs). The platform has facilitated over $400 million in total value locked (TVL) across various LRT liquidity pools, offering unique features such as yield-bearing native technology, tailored AMM logic, and boosted points exposure. Notable collaborations include partnerships with protocols like Lido Finance, Rocket Pool, Frax Finance, Swell Network, Stakewise, Renzo Protocol, and EtherFi. Balancer has launched innovative liquidity pool configurations, including the first-ever Tri-LRT pool offering quadruple points from multiple LRT protocols. With over $6.5 billion in TVL across Eigen Layer and LRT protocols, Balancer aims to provide users with seamless and diversified exposure to the liquid restaking ecosystem.

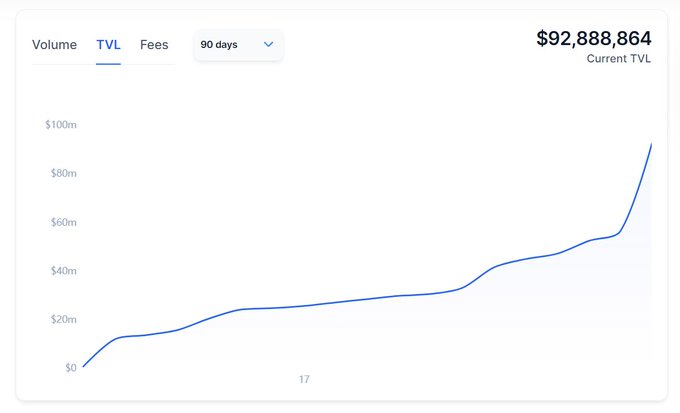

The inexorable rise of the Tri-LRT pool continues! 📈 With more than $90M in TVL, it's now almost the third-biggest pool on @Balancer. Deposit to earn four types of points in one fell swoop: app.balancer.fi/#/ethereum/poo…

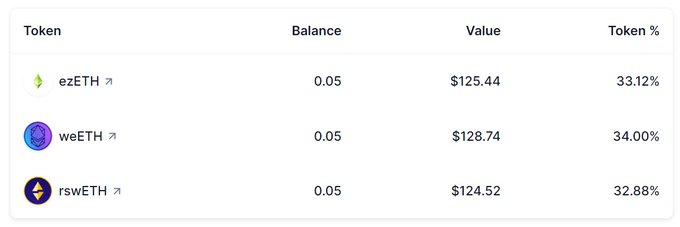

Quadruple points earning, anyone? We've teamed up with @RenzoProtocol and @Ether_Fi to introduce the first ever Tri-LRT pool! This revolutionary pool enables you to earn four points at once: ✅EigenLayer Restaked Points ✅Swell Voyage Pearls ✅Renzo ezPoints ✅EtherFi Points

1/ This one position unlocks unparalleled exposure to the @eigencloud points system. Alongside Eigen points, this Tri-LRT pool offers 2x points for @RenzoProtocol, @ether_fi, and @swellnetworkio on the WHOLE LP till March 12th! app.balancer.fi/#/ethereum/poo… A 🧵

$614,890,000 is hosted within LST liquidity pools on Balancer. $529,800,000 is hosted within unique #ve8020 governance positions. And, over $2,700,000,000 swap volume has been routed through protocols built on top of Balancer Technology. balancer.fi

With over $6.5b in TVL, @eigencloud / LRT protocols have become a DeFi powerhouse & Balancer offers users the most seamless route to gain diversified exposure. • 1 LP • 3 LRTs • 4 point systems (100% of LP counts) • 2x bonus points till March 10th app.balancer.fi/#/ethereum/poo…

Balancer's Yield-bearing native tech has facilitated over $216.1m of LST volume on a $19.7m $wstETH / $ETH Pool in the last 24 hours. That's over a 1000% utilization rate. #BuildBetter app.balancer.fi/#/ethereum/poo…

1/ Balancer hosts over $160,000,000 in LRT liquidity, and it's not stopping there. In collaboration with @KelpDAO, @staderlabs_eth, and @aurafinance, here's what you should know about the new 3x point boosted $rsETH LP! A 🧵 app.balancer.fi/#/ethereum/poo…

Balancer hosts over $200,000,000 in Liquid Restaking Token liquidity. ✅ Unique TRI and dual LST pools ✅ AMM logic tailored for Yield bearing assets ✅ Boosted LRT Points and Eigen Layer exposure app.balancer.fi/#/ethereum

Balancer continues to be the focal hub for LRT liquidity.

To begin with, you can already provide liquidity to the $KEP <> $rsETH pool on @Balancer and get 3x boosted Kelp Miles! 🌱 app.balancer.fi/#/ethereum/poo…

Balancer is the native LRT liquidity layer, and @vectorreserve is the latest protocol to enter the ecosystem with DeFi's first Liquidity Position Derivative (LPD). ✅ Enhanced LRT rewards ✅ $ETH superfluid staking ✅ Points exposure ✅ 100% YB LP app.balancer.fi/#/ethereum/poo…

Over the past few weeks, Balancer Tech has grown to host over $100,000,000 in Liquid Restaking Token liquidity. From 4x point exposure tri-list pools to 100% YB LPs with self-sustaining core pool mechanics, the Balancer LRT flywheel is only just getting started. #BuildBetter

With over $118m in liquidity, Balancer has already cemented itself as the LRT hub. That's only the start... "In essence, Aura represents the missing piece of the puzzle, seamlessly integrating with Balancer’s technology to create a synergy that amplifies the benefits of LRTs

The rise of LRTs is sparking a DeFi renaissance! @eigencloud holds over 2% of the total ETH supply (~7B USD), attracting protocols like @RenzoProtocol, @swellnetworkio, and @ether_fi by driving up yields across the board. This is how Aura will supercharge LRT liquidity 🧵

Balancer - The DEX for Liquid Restaking Tokens. You can now toggle pool filters and select "LRT" to see unique liquidity pools built in collaboration with @RenzoProtocol @ether_fi @swellnetworkio @KelpDAO and @vectorreserve. Check it out! app.balancer.fi/#/

After a 12,313% TVL growth in just 22 days, the only Tri Liquid Restaking pool in DeFi begins its next stage of sustainable growth. Here's what you should know about the @ether_fi, @RenzoProtocol, and @swellnetworkio Tri LRT LP on Balancer. A mini 🧵

This Tri-LRT pool has just surpassed $77,000,000 in TVL. With 2x points for EACH LRT protocol on the FULL LP till the 12th of March, this pool is effectively a supercharged 6X diversified points trifecta! Check it out. app.balancer.fi/#/ethereum/poo…

$34M is now deposited in the first ever Tri-LRT pool!📈 Now among the top 6 on @Balancer, the pool is a historic first and offers quadruple points from @ether_fi @eigencloud, @RenzoProtocol and Swell. Ask your questions about the pool in the comments! app.balancer.fi/#/ethereum/poo…

You can now unlock the power of Liquid Restaking Tokens on an Ethereum Layer 2! In collaboration with @RenzoProtocol and @chainlink, an $ezETH $wstETH LP is now live on Arbitrum with 2x points! app.balancer.fi/#/arbitrum/poo…

Are you paying attention? ✅ $10 billion in volume ✅ $400 million in TVL In collaboration with @LidoFinance @Rocket_Pool @fraxfinance @swellnetworkio @stakewise_io @RenzoProtocol @ether_fi @stakewise_io Balancer is becoming the dominant LST/LRT hub. dune.com/balancer/lst

One Pool. Three LRTs. 4 Different Point systems. 100% of your LP earns points, with 2x points for @swellnetworkio, @ether_fi, and @RenzoProtocol for one month. 1️⃣ Mint or swap into $ezETH $weETH and $rswETH. 2️⃣ Deposit liquidity into the pool below. app.balancer.fi/#/ethereum/poo…

🔥 Team Updates on reCLAMMs Development

The Balancer team shared updates on reCLAMMs during their latest Office Hours session. **Key Points:** - @mendesfabio provided progress updates on reCLAMM development - Special announcements directed at both pre-TGE and post-TGE projects - Follows previous deep-dive sessions explaining how developers and liquidity providers can optimize these pools reCLAMMs represent Balancer's concentrated liquidity solution, designed to improve capital efficiency for both projects launching tokens and existing protocols.

Balancer V3 Rethinks DeFi Security with Prevention-First Architecture

Balancer has published a comprehensive technical breakdown explaining why V3 represents a fundamental shift in DeFi security philosophy: **prevention over reaction, architecture over patches**. **Key architectural improvements:** - **Centralized accounting** - V3's vault implements ERC20MultiToken pattern, handling all pool tokens and minting/burning directly, eliminating V2's distributed state synchronization risks - **Consolidated rounding logic** - All rounding moved to vault level with explicit `invariant_up` and `invariant_down` functions, replacing V2's scattered approach across pools - **Radical simplification** - Pools now implement just three functions (onSwap, computeInvariant, computeBalance), moving complexity to the vault and reducing custom AMM development from months to days - **Built-in security guarantees** - EIP-1153 transient storage eliminates reentrancy vulnerabilities, vault-managed tokens remove attack surfaces, no external oracle dependencies for core operations The architecture eliminates entire categories of vulnerabilities including core rounding errors, attack amplification paths, and ensures atomic state management. Following the November 3rd exploit, the team is building for attack vectors that might emerge years from now. [Read full technical breakdown](https://medium.com/balancer-protocol/balancer-v3-here-to-stay-9ec37439b4be?postPublishedType=repub)

V3 Introduces Transient Reentrancy Guard to Block DeFi Attack Vector

Balancer V3 implements a new security mechanism called a **transient reentrancy guard** that prevents simultaneous access to smart contracts. **How it works:** - Functions like a bank vault door that cannot be opened twice at once - Uses EIP-1153 for transient accounting - Eliminates reentrancy vulnerabilities at the protocol level Reentrancy attacks have been a persistent security issue in DeFi, allowing malicious actors to repeatedly call functions before previous executions complete. V3's architectural approach removes this attack surface entirely through vault-managed token handling and no external oracle dependencies for core operations. The guard makes it physically impossible for attackers to exploit this vulnerability, representing a fundamental security improvement over previous versions.

Balancer V3 Introduces Hospital-Style Role Separation for Enhanced Security

**Balancer V3 implements multi-level access control** similar to hospital operations, where each role has strictly defined permissions. **Key features:** - Vault, pools, and controllers operate only within designated permissions - Surgeons perform surgery, pharmacists access medication, admins change records - Role separation prevents unauthorized access across system components This architectural approach builds on V3's security foundation, which includes EIP-1153 for reentrancy protection and vault-managed token handling.

Balancer V3 Introduces Transient Accounting for Atomic Token Settlements

Balancer V3 implements **transient accounting**, a mechanism ensuring all token movements must settle within a single transaction or the entire operation reverts. **Key features:** - Every operation resolves atomically - Eliminates synchronization risks present in V2's distributed state model - V3's vault uses ERC20MultiToken pattern, managing all pool tokens and minting/burning directly This architectural shift addresses V2's challenges with token balances spread across vaults and BPT logic in pools, providing **state atomicity by design**.