Azuro Expands Beyond Sports Betting into Diverse Prediction Markets

Azuro Expands Beyond Sports Betting into Diverse Prediction Markets

🎲 Bet on Everything Now

Azuro Protocol announces expansion beyond sports betting into broader prediction markets, enabling markets for:

- Elections

- Token price movements

- Reality TV shows

- Meme trends

The protocol maintains its core features:

- No KYC requirements

- Non-custodial infrastructure

- Automated market making (vAMM)

- Cross-chain compatibility

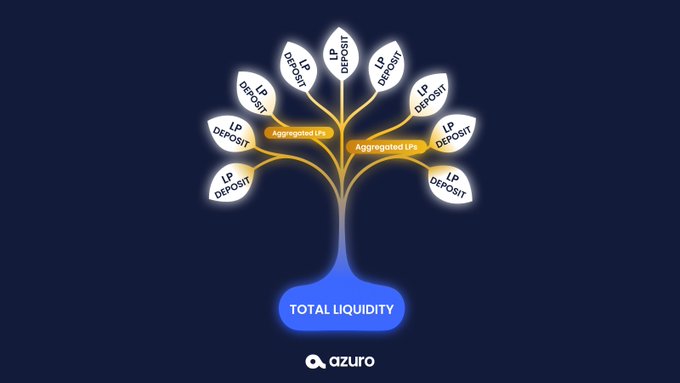

- Decentralized liquidity pools

This expansion represents a significant evolution in Azuro's infrastructure, allowing developers to create prediction markets for virtually any outcome-based event.

Tweet not found

The embedded tweet could not be found…

❓Can prediction markets be more than just sports? Absolutely. With Azuro, you can launch markets on anything with an outcome: 🏛️ Elections 📉 Token prices 📺 Reality shows 🧠 Meme wars Prediction markets are bigger than sports. Want to build your own? DM us 👇

🔥Congrats @DexWin_Sports on going live with Azuro V3! New odds engine. Gasless bets. Smoother markets. Let’s keep building the future of onchain prediction.

✨ DexWin 🤝 @azuroprotocol = An upgraded world class web3 betting! ✨ We're now upgraded to Azuro V3 and there's a lot of amazing updates for you! 🏆 💰Try it out NOW and get Instant Bonuses on EVERY BET! 💰 It's BIG MONEY season on DexWin! 😎

Azuro isn’t just another betting protocol. It’s rewriting the backend of onchain predictions. Here’s how it works under the hood – simple & onchain-native 🧵

Azuro is not an app. It’s the protocol layer that makes betting modular 🧩 Frontends can mix & match: ✅Markets ✅Odds engine ✅UX style Like Lego - but on-chain 🔗

Congrats @DGbet_official on going live with Azuro V3! 🧩 Clean odds. Gasless UX. A smoother onchain experience. Let’s go! 🔥

🔥It’s here! Azuro V3 Week starts now. A new standard for onchain prediction begins today! And we’re starting by rewriting how odds work. 🎯 Odds no longer pass through a middle layer. No slippage. No silent changes. No “adjustments”. You get them raw - straight from the

Azuro V3 isn’t just better for users. It’s a serious upgrade for stakers & liquidity providers💧📈 – More markets bring more volume – Improved risk logic enhances capital efficiency – Unified flow removes version fragmentation And yes - staking is still liquid & earning. No

⚙️ Most prediction protocols either: - set odds manually - mimic order books - or just fake it Azuro does something better.👇

Azuro V3 brings smarter risk 🛡 Unfair edge strategies? Mitigated. Volatile flows? Smoothed. 💡 Apps see better margins 💰 LPs benefit from healthier markets No bans. No retroactive changes. Just smarter protection - baked into the protocol.

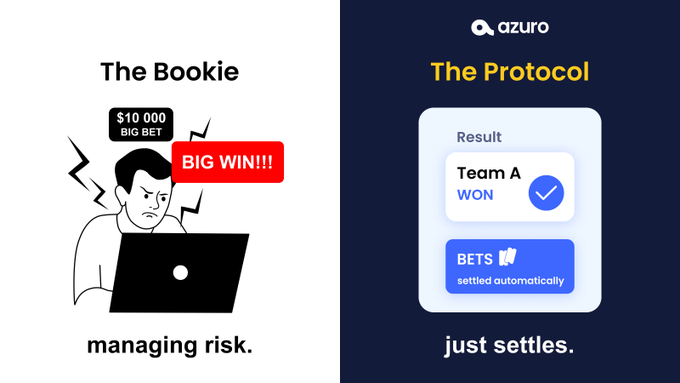

Most betting platforms want to manage risk. Azuro doesn’t care who wins. It simply settles the outcome - transparently, onchain. That’s the difference between being the house… and building the rails 🛠️

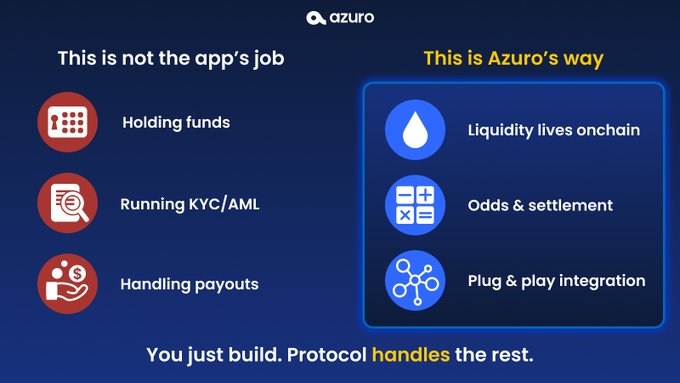

🏦 Betting apps are not a bank. So why hold funds, run KYC, or manage payouts? With Azuro, devs don’t custody assets. They just build UX on top. Infra takes care of the rest ✅

📣 Azuro just leveled up on @Chiliz The number of prediction markets just got a massive upgrade. More leagues. More matches. More markets. And that means even more chains where prediction markets are live and growing. Azuro infra keeps expanding 🛠️📈

🛰️🔗Ever wondered where onchain odds actually come from? In Azuro, odds don’t come from a central “house.” They’re supplied by independent data providers - competing to feed markets with quality and speed. That’s how odds go onchain.

🔄 Live or prematch? Doesn’t matter anymore. Azuro V3 unifies both: 🧠 One logic 📊 One odds engine ⚡️ Same fast execution And now - for the first time: Players can combine live and prematch events in a single combo bet 🎯 No confusion. No fragmentation. Just prediction -

Clean integration from @GiraftSports 🧩 Azuro V3 infra, live markets, real odds - all running smoothly. More to come!

Giraft is now live on @azuroprotocol V3! 🦒⚡ The next-gen sports betting experience is here: 🔥 Raw provider odds 🔥 Unified live & prematch markets 🔥 Smarter market logic 🌀 Gasless bets coming soon Now live on @0xPolygon , @gnosischain , and @base — more EVMs coming soon.

🧩Betting through Azuro Protocol means: – No accounts – No KYC – No counterparty Just connect a wallet, make a transaction, and track everything on-chain. This is what Web3 betting infrastructure actually looks like. Seen how it works yet? 👀

Prediction Markets Becoming Default Discovery Layer for Information

**Prediction markets are evolving beyond betting** into a core information discovery mechanism. - People increasingly check **real-time odds before reading news** - Markets surface expectations **faster than narratives form** - This creates a new **default layer for discovering what matters** The shift represents prediction markets becoming **embedded infrastructure** rather than standalone platforms. Real-time odds are positioning themselves as the primary filter for information relevance. This evolution transforms how we **consume and prioritize information** - moving from narrative-driven discovery to expectation-based filtering.

Multi-Signature Security Setup Requires Multiple Keys for Transaction Approval

A **multi-signature security system** is being implemented that requires multiple keys to approve transactions before any funds can move. This setup ensures that: - No single person can authorize transactions alone - Multiple parties must collaborate to approve any movement of assets - Enhanced security through distributed control The system appears to be part of ongoing infrastructure development, with hints suggesting something is "waiting to be unlocked" once the proper keys are obtained.

🇯🇵 Yen Funding Crisis

**Rising Japanese yields are disrupting the global carry trade**, potentially triggering massive capital flows back to Japan. For years, investors borrowed yen at ultra-low rates to fund investments worldwide. Now, as **funding costs climb**, this cheap money may reverse course. Key impacts: - Tightening liquidity across all risk assets - Pressure on crypto markets - Potential unwinding of leveraged positions Short-term Japanese yields hit **2008 highs**, strengthening the yen and already pressuring crypto during Asian trading hours. The carry trade unwind could reshape global markets as **trillions in borrowed capital** seeks higher-yielding Japanese assets.

🇧🇷 Brazil's Stablecoin Takeover

**Brazil's crypto landscape has shifted dramatically** - stablecoins now account for approximately **90% of the country's total cryptocurrency trading volume**. This dominance represents a significant change in how Brazilians interact with digital assets, moving away from speculative trading toward more stable, utility-focused cryptocurrency use. **Key implications:** - Stablecoins are becoming the primary crypto rails in Brazil - This shift suggests growing preference for price stability over volatility - Could indicate broader adoption for payments and remittances The trend raises interesting questions about **predictive market potential** - stablecoin flow patterns and velocity could potentially serve as early economic indicators, revealing market sentiment and capital movements before traditional metrics catch up. Brazil's experience may preview similar adoption patterns in other Latin American markets facing currency instability.

S&P Downgrades USDT to Lowest Rating Despite Tether's Treasury Holdings

**S&P Global has downgraded Tether (USDT) to its lowest stability rating**, citing concerns over: - Bitcoin exposure in reserves - Gold holdings and loan positions - Limited transparency in audits - Governance issues **Tether strongly disputes the downgrade**, highlighting that: - 75% of reserves are held in US Treasuries - Company ranks as 17th-largest Treasury bill holder globally - Reserve composition has become more conservative The conflicting perspectives raise questions about **stablecoin risk assessment standards** and whether traditional rating agencies fully understand crypto asset backing structures. This downgrade could impact institutional adoption and regulatory discussions around stablecoins.