Azuro Processes $383M in Volume as Onchain Betting Infrastructure

Azuro Processes $383M in Volume as Onchain Betting Infrastructure

🎲 The backend revolution

Azuro has processed over $383M in betting volume by providing backend infrastructure for sportsbooks rather than competing with them directly.

The platform offers three core features:

- Open liquidity pools accessible across platforms

- Onchain settlement for transparent transactions

- Modular markets for flexible betting options

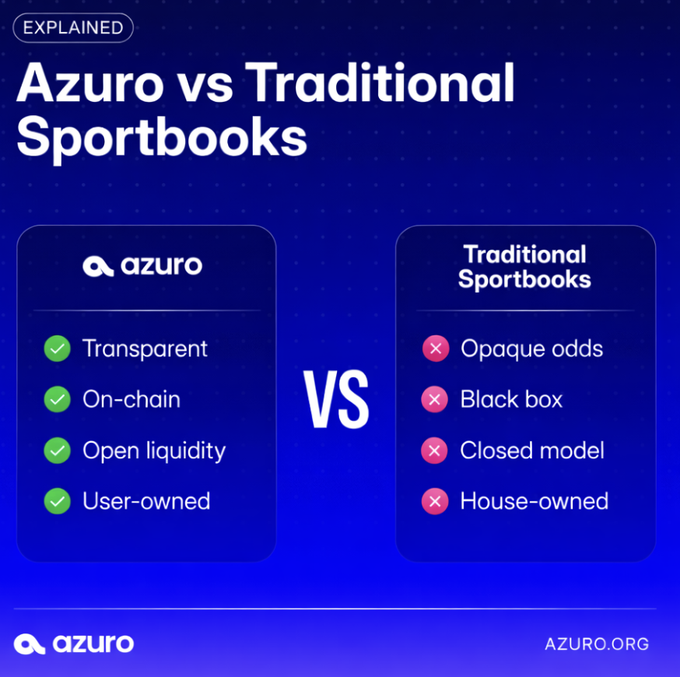

Unlike traditional Web2 betting platforms, Azuro enables real-time odds updates, instant liquidity flows, and automated result settlement without support tickets. The infrastructure approach allows sportsbooks to leverage blockchain benefits while maintaining their own frontend experiences.

Azuro doesn’t compete with sportsbooks. It replaces their backend. > Open liquidity. > Onchain settlement. > Modular markets. Over $383M in volume processed and we are still just beginning.

Prediction Markets Becoming Default Discovery Layer for Information

**Prediction markets are evolving beyond betting** into a core information discovery mechanism. - People increasingly check **real-time odds before reading news** - Markets surface expectations **faster than narratives form** - This creates a new **default layer for discovering what matters** The shift represents prediction markets becoming **embedded infrastructure** rather than standalone platforms. Real-time odds are positioning themselves as the primary filter for information relevance. This evolution transforms how we **consume and prioritize information** - moving from narrative-driven discovery to expectation-based filtering.

Multi-Signature Security Setup Requires Multiple Keys for Transaction Approval

A **multi-signature security system** is being implemented that requires multiple keys to approve transactions before any funds can move. This setup ensures that: - No single person can authorize transactions alone - Multiple parties must collaborate to approve any movement of assets - Enhanced security through distributed control The system appears to be part of ongoing infrastructure development, with hints suggesting something is "waiting to be unlocked" once the proper keys are obtained.

🇯🇵 Yen Funding Crisis

**Rising Japanese yields are disrupting the global carry trade**, potentially triggering massive capital flows back to Japan. For years, investors borrowed yen at ultra-low rates to fund investments worldwide. Now, as **funding costs climb**, this cheap money may reverse course. Key impacts: - Tightening liquidity across all risk assets - Pressure on crypto markets - Potential unwinding of leveraged positions Short-term Japanese yields hit **2008 highs**, strengthening the yen and already pressuring crypto during Asian trading hours. The carry trade unwind could reshape global markets as **trillions in borrowed capital** seeks higher-yielding Japanese assets.

🇧🇷 Brazil's Stablecoin Takeover

**Brazil's crypto landscape has shifted dramatically** - stablecoins now account for approximately **90% of the country's total cryptocurrency trading volume**. This dominance represents a significant change in how Brazilians interact with digital assets, moving away from speculative trading toward more stable, utility-focused cryptocurrency use. **Key implications:** - Stablecoins are becoming the primary crypto rails in Brazil - This shift suggests growing preference for price stability over volatility - Could indicate broader adoption for payments and remittances The trend raises interesting questions about **predictive market potential** - stablecoin flow patterns and velocity could potentially serve as early economic indicators, revealing market sentiment and capital movements before traditional metrics catch up. Brazil's experience may preview similar adoption patterns in other Latin American markets facing currency instability.