Aura Finance, a decentralized finance platform, has announced that liquidity providers in its GYD pools can earn 5 times the SPIN token rewards and 25-41% additional rewards from AURA/BAL tokens. This incentive aims to boost yield potential for DeFi stakeholders while providing better liquidity pool diversification against de-pegging risks and servicing trading volumes through GYD. Aura Finance's community initiative focuses on enhancing yield opportunities and governance power for DeFi participants, starting with Balancer.

LPs in GYD pools earn 5x SPIN and 25-41% currently from AURA/BAL rewards on @AuraFinance While enjoying better LP diversification against depeg risks and servicing volumes through GYD.

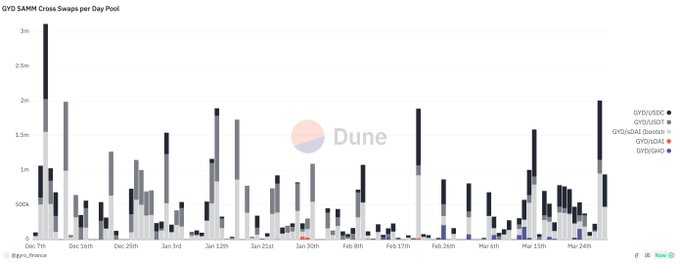

GYD did 2m volume from cross-swaps yesterday. And 1m so far today. This is volume routed across GYD but arising from independent swaps between USDC, USDT, and DAI. E.g., USDC <> GYD <> USDT GYD LPs get volume while enjoying diversification against depeg risks.

Balancer v2 Composable Stable Pools Hit by Significant Exploit

Balancer's v2 Composable Stable Pools suffered a **significant exploit**, impacting the DeFi protocol's ecosystem. **Key Details:** - Only v2 Composable Stable Pools were affected - Other pool types remain unaffected and operational - Recovery efforts are currently ongoing - Engineering and security teams are actively investigating **Current Status:** Balancer has released a preliminary incident report detailing the exploit. The team is working on recovery while maintaining transparency with the community. **User Safety:** Users should avoid engaging with potential scam messages or phishing attempts that may exploit this situation. The protocol continues operating normally for unaffected pools while addressing the security breach.

**uniETH Pool Delivers 21% Yield as Gas Fees Drop**

The **uniETH | WETH pool** on Mainnet is currently offering **21% vAPR** through Aura Finance. **Bedrock DeFi** originally designed uniETH for institutional users, but an unexpected shift has occurred. With **gas fees routinely under 1 gwei**, DeFi-native users are now the primary beneficiaries capturing this yield. This represents a notable trend where **lower transaction costs** are making institutional-grade products more accessible to retail DeFi participants. [Access the pool](https://app.aura.finance/#/1/pool/222)

slpETH-gtWETHe Pool Launch on Balancer with Aura Rewards

Loop Finance's slpETH, a restaking-powered ETH receipt token designed for auto-leveraged yield, has formed a new partnership with Gauntlet's gtWETHe in a boosted Balancer pool. The pool is now live on Aura Finance offering a 22% variable APR for liquidity providers. - Pool combines two innovative ETH receipt tokens - Available on [Aura Finance](https://app.aura.finance/#/1/pool/256) - Current vAPR: 22% This launch expands the ecosystem of automated yield strategies on Balancer, following successful implementations like Tokemak's Autopilot.

GHO-EURC Pool Launch on Base

A new liquidity pool combining GHO and EURC stablecoins has launched on Base, offering 12% APR. - GHO: Backed by Aave, a leading DeFi lending protocol - EURC: Circle-issued, same team behind USDC - Platform: Available on Aura Finance - Features: Implements Balancer's StableSurge Hook for enhanced swap fees during volatility The pool provides an opportunity to earn yield while supporting euro-denominated stablecoin liquidity on Base. [Join the pool on Aura Finance](https://app.aura.finance/#/8453/pool/22)

Balancer v3 Boosted Pools Launch Multiple Yield Sources

Balancer v3's new Boosted Pools are revolutionizing liquidity provision by offering multiple yield sources in a single vault. Key features include: - **Simplified LP Experience**: Users can access various yield sources through one straightforward position - **Multiple Revenue Streams**: Earnings from trading fees, lending protocols, yield-bearing tokens, and token emissions - **Notable Pools**: - csUSDC | csUSDL pool with Morpho yields - pxETH | WETH pool featuring Dinero and Morpho integration - GHO | USDC | USDT pool earning Aave yields Pools are now live on Ethereum, Gnosis Chain, and other networks via [Aura Finance](https://app.aura.finance).