Arbitrum DRIP Epoch 7 has officially launched, offering new opportunities for users to earn additional ARB token incentives.

The program allows participants to:

- Explore earning opportunities across multiple supported protocols

- Stack extra ARB rewards through various DeFi activities

- Access updated incentive structures for the new epoch

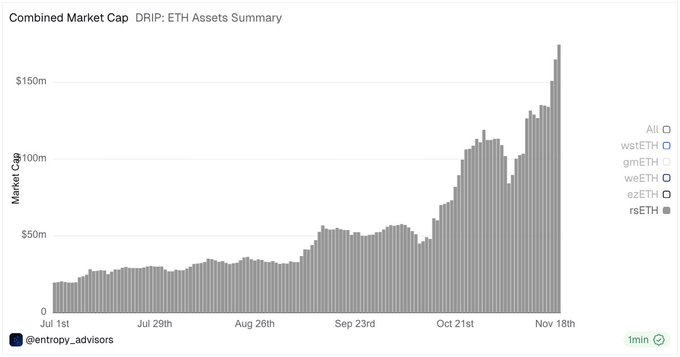

Previous epochs showed strong performance, with rsETH's market cap on Arbitrum surging approximately 450% during DRIP's runtime.

Epoch 7 of @arbitrum DRIP is now live 🌊 Explore opportunities across supported protocols and stack extra ARB incentives. Check it out! ⚓ arbitrumdrip.com/opportunities

Put your ETH to work on Arbitrum with ~2M ARB rewards in Epoch 7 of DRIP! ETH caps have recently been increased on Aave along with new opportunities across Arbitrum's top lending markets. Join the DeFi Renaissance at arbitrumdrip.com💧

Epoch 6 of @arbitrum DRIP is now live 🌊 Explore opportunities across supported protocols and stack extra ARB incentives. Check it out! ⚓ arbitrumdrip.com/opportunities

The DeFi Renaissance enters its next phase with Epoch 6 of DRIP! Main focus for this phase is ETH Explore new ways to put your ETH to work across Arbitrum’s top lending platforms below arbitrumdrip.com

1 week left in Epoch 6 of @arbitrum DRIP and rsETH isn’t slowing down. rsETH’s market cap on Arbitrum is up ~450% since the start of DRIP and is still climbing 🌊 New epoch, new opportunities. Stack extra ARB rewards across supported protocols. ⚓ arbitrumdrip.com/opportunities

.@KelpDAO's rsETH just hit a new ATH on @arbitrum! Since the start of DRIP its market cap has grown by ~5.5x, from $32m to $175m 📈

wrsETH Supply Cap Doubles on Aave Avalanche Market

**wrsETH supply caps increased to 10k tokens** on Aave v3's Avalanche market after the initial 5k cap filled rapidly. The liquid restaking token launched on Avalanche just last week and quickly reached maximum capacity, prompting this expansion. - Previous cap: 5k wrsETH - **New cap: 10k wrsETH** - Available for deposit now This follows a pattern of high demand for liquid staking derivatives across DeFi protocols, with similar cap increases needed on other networks. [Deposit wrsETH on Aave Avalanche](https://app.aave.com/reserve-overview/?underlyingAsset=0x7bfd4ca2a6cf3a3fddd645d10b323031afe47ff0&marketName=proto_avalanche_v3)

Equilibria Voting Market Opens with 9,372 KERNEL Tokens Available

**Equilibria's weekly voting market is now active** with 9,372 $KERNEL tokens available as rewards. Users can vote for three specific pools to earn their share: - rsETH pool - agETH pool - hgETH pool This represents an **increase from previous weeks** - up from 8,460 tokens last week and 8,220 tokens in mid-November. [Vote now on Equilibria](https://equilibria.fi/vote) to participate in the reward distribution.

🚀 Kernel Points Boost

**Stable Gain enhances rewards for sbUSD holders** KelpDAO's Stable Gain vault now offers additional incentives: - **10 Kernel Points daily** per 1,000 sbUSD held - Points **backfilled** for historical balances - **Automatic stacking** with no extra steps required - Updated totals visible on dashboard sbUSD continues providing risk-managed stablecoin yields while now earning bonus points. [Deposit in Stable Gain](https://kerneldao.com/kelp/gain/stable-vault/?utm_source=social)

Kelp's High Gain vault outperforms competitors by 50% in November

**Kelp delivered strong performance across all products in November:** **Gain Vaults Performance:** - **High Gain (hgETH)** maintained #1 position among ETH vaults >$10M TVL with **13%+ rewards** - **Airdrop Gain (agETH)** achieved ~12% weekly rewards with $45M+ TVL - **Stable Gain (sbUSD)** held steady at ~11% rewards with $8M+ TVL **rsETH Expansion Milestones:** - wrsETH launched on Aave v3 Avalanche with 5k supply cap - Native rsETH minting went live on Ink blockchain - Arbitrum TVL hit **$183.9M**, maxing out 60k ETH supply cap - Market cap reached ~$175M (+450% since DRIP launch) **DRIP Epoch 7** deployed with ~2M ARB incentives for ETH strategies. **Community Updates:** Co-founder spoke at NextFin NYBW about Kred's "Internet of Credit" - connecting DeFi with traditional finance through stablecoin liquidity. All three Gain vaults consistently delivered 10%+ rewards despite market volatility, showcasing the platform's risk-adjusted strategy approach.

**DeFi Vaults: Beyond Simple Deposit-Withdraw Mechanics**

**DeFi vaults appear straightforward** - deposit, earn rewards, withdraw. But the reality involves complex backend operations. **What actually happens:** - Tokenization processes - Multi-protocol strategy execution - Continuous risk management - Strategic logic implementation **Key components include:** - Fee structures - Oracle integrations - Contract quality assurance - Automated rebalancing Vaults handle diverse strategies: farming, lending, staking, and delta-neutral positions. Some build on others, creating modular systems. **The automation depends entirely on code quality** - making due diligence essential before depositing funds. For detailed technical breakdown: [KernelDAO Blog](https://blogs.kerneldao.com/blog/what-happens-behind-the-scenes-from-user-deposit-to-vault-deployment)