Ethereum leads developer adoption - confirmed as #1 ecosystem for new developers in 2025, benefiting Arbitrum's growth.

DeFi Renaissance gains momentum - Stablecoin growth surged $700M+ on Arbitrum last month through major protocols:

- Aave, MorphoLabs, Euler Finance contributing

- Fluid's deposits crossed $380M

- Spark's sUSDS jumped from $16M to $61M

Trading volume milestones:

- OstiumLabs hit $568M daily volume ATH on anniversary

- Ostrich reached $2B total trading volume

- Variational tightened spreads for cheaper trading

New launches and growth:

- VeloraDEX launched with intent-based orders

- Giza reached $2M assets under management in 48 hours

- WINR Protocol celebrated 1-year anniversary with $250M+ volume

Community expansion - Jakarta builder meetup announced for local developers and founders.

It's been a great week on Arbitrum - RWAs on Arbitrum reach $490M+ - @variational_io hits $3.8B total volume traded - @etherealdex Mainnet Alpha launching Oct 20th - Stablecoin revolution up and to the right with @USDai_Official USDai/sUSDai reached $375M TVL in @pendle_fi -

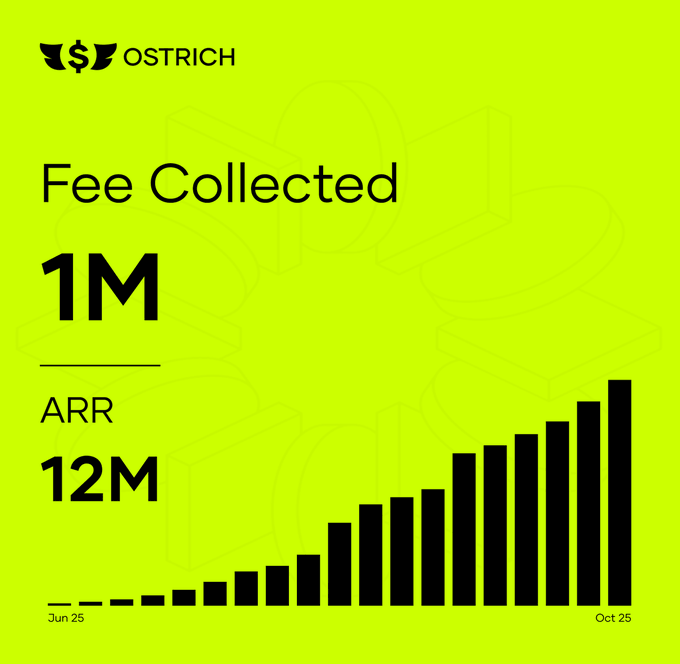

Congrats to the folks at @Ostrich_HQ on reaching $1M in fee collected and $12M in annualized revenue run rate! Arbitrum is the home of fast product market fit and revenue for apps Arbitrum Everywhere. Ostrich Everywhere

$1 million fee milestone unlocked One step closer to bringing trillions on @arbitrum Arbitrum Everywhere. Ostrich Everywhere

Lots of massive wins this week from our builders 🏆 - @RobinhoodApp 400+ Stock Tokens are live in the EU powered by Arbitrum - Arbitrum launches season 2 with 700K ARB up for grabs through @KaitoAI (don't stop yapping) - @Ostrich_HQ reaches $1M in fee collected and $12M in

Huge wins from our builders this week! 🏆 - @Ethereum is the #1 ecosystem for new developers in 2025 (A win for Ethereum is a win for Arbitrum) - Stablecoin growth increased $700M+ on Arbitrum last month from @aave, @MorphoLabs, @eulerfinance, @0xfluid, @SiloFinance, and

It's been a bullish week on Arbitrum - RWA's hit an ATH of $480M+ - @moonpay is now available to all apps that integrate the embedded Arbitrum Bridge -> App-native onboarding - @Ostrich_HQ reached $1B in total volume - @OstiumLabs open interest in commodities reached ATH of

🎉 Ostium Labs Hits $22.2B Volume Milestone on Arbitrum After Just One Year

**Ostium Labs celebrates its first anniversary on Arbitrum** with impressive metrics that showcase rapid growth in the L2 ecosystem. Key achievements in just 12 months: - **Total trading volume**: $22.2B+ - **Total trades executed**: 300K+ - **Active users**: 13.6K+ The milestone demonstrates **strong adoption** of Arbitrum's scaling solution and highlights how quickly projects can gain traction on Layer 2 networks. Ostium's growth reflects the broader **momentum in Arbitrum's ecosystem**, where projects are achieving significant volume and user engagement faster than traditional Layer 1 alternatives.

🦀 Rust Meets Arbitrum

**Thirdweb** is streamlining Rust smart contract deployment on **Arbitrum** through their Stylus integration. Key developments: - Builders can now easily ship apps using **Rust smart contracts** on Arbitrum - Thirdweb offers **one free month** of their Growth Plan with code STYLUS-GROWTH - Part of Arbitrum's broader **Stylus Sprint** program supporting Rust development The integration addresses a growing need as more developers seek alternatives to Solidity. Rust offers **memory safety** and **performance benefits** for smart contract development. Other Stylus Sprint participants include: - **RedStone** building cheaper, more secure oracles - **Arc, Playgrounds, and EmberAGI** enabling AI integration - **Trail of Bits** developing auditing tools This move positions Arbitrum as a **Rust-friendly** L2 solution, potentially attracting developers from traditional software backgrounds to Web3. [Learn more about Thirdweb's Stylus integration](https://blog.arbitrum.io/how-thirdweb-uses-arbitrum-stylus-to-power-the-next-wave-of-onchain-apps/)

Robinhood Launches 400+ Stock Tokens on Arbitrum for EU Users

**Robinhood has officially launched 400+ tokenized stocks** on Arbitrum One for European Union users through their mobile app. **Key developments:** - EU customers can now trade US stocks and ETFs as blockchain tokens - Seamless user experience - looks identical to traditional trading - Built on Arbitrum's Layer 2 infrastructure for lower costs **What this means:** - Major step toward **DeFi and TradFi convergence** - Millions of new users entering crypto ecosystem - Removes geographical barriers for stock investing This represents a significant milestone in bringing traditional finance onto blockchain rails while maintaining familiar user interfaces.

💧 DRIP Epoch 4 Launches

**DRIP Epoch 4 is now live** on Arbitrum, marking another phase of the DeFi Renaissance initiative. **Key highlights:** - Arbitrum saw **$700M+ stablecoin growth** last month - Multiple lending protocols participating: Aave, Morpho Labs, Euler Finance, Fluid, Silo Finance, and Dolomite - Users can **deposit, borrow, and loop** across these platforms The program continues to drive DeFi activity on Arbitrum's Layer 2 network, building on previous epochs' momentum. [Participate at arbitrumdrip.com](http://arbitrumdrip.com)