API3 Discontinues Certain Data Feeds, Focuses on High-Demand Offerings

API3 Discontinues Certain Data Feeds, Focuses on High-Demand Offerings

🔍 Data feed shakeup...

API3 announces the discontinuation of equities, forex, and commodities data feeds on the API3 Market, effective October 1. This decision aims to optimize offerings and reduce maintenance costs.

Key points:

- Focus shifts to high-demand data feeds

- 170+ data feeds remain available on API3 Market

- Popular feeds include cryptocurrencies, LST/LRT, and stablecoins

The API3 Market continues to provide an easy-to-use platform for browsing, accessing, and managing various data feeds.

Call to Action: Visit API3 Market to explore available data feeds and start building.

API3's governance is fully decentralized—by the community, for the community. Join the DAO! Earn a variable APR of 34.5%, gain governance voting power, & stake your claim to helping redefine the oracle landscape around API3's Oracle Stack. tracker.api3.org

There was a time in the early days of DeFi when bringing data onchain was enough-but those days are over. The next generation of oracles will drive protocol performance by recapturing MEV & enhancing efficiency. 🚀 It's time to upgrade your oracle. 🧵⬇️ link.medium.com/768BdLjFFMb

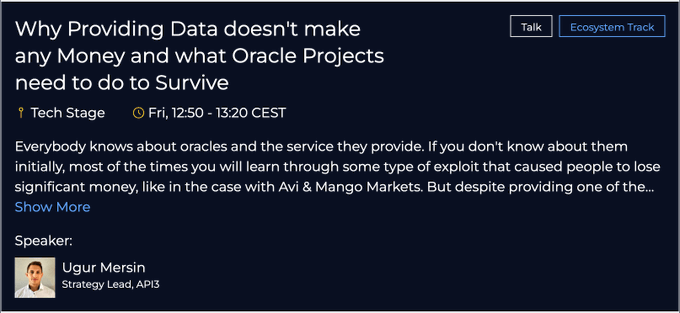

Join us at @ETHWarsaw to discover how API3 is changing the oracle landscape. @UgurMersin61 will discuss why most oracle projects struggle to find a viable business model and how @OEVNetwork is set to transform the space. ⏰ Thursday 12pm on Masuria Stage

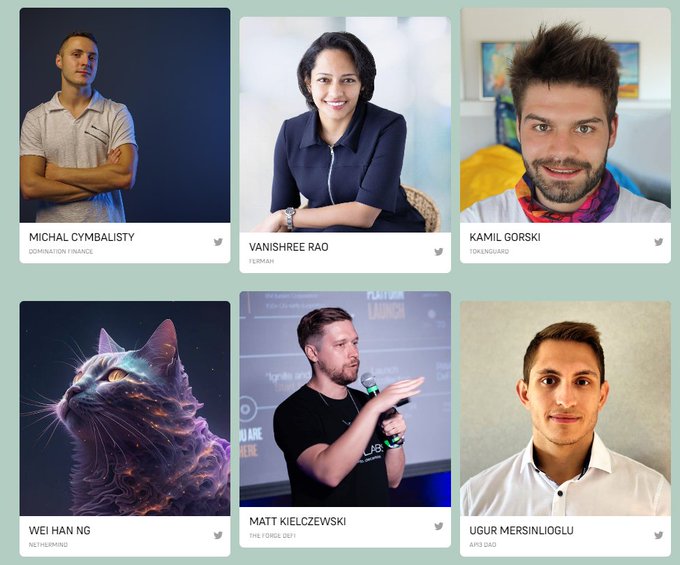

🙌🏻 We continue to announce our speakers, who will share their ideas and web3 expertise during the talks, workshops and panels: 🔸 @michalcym from @dominationfi 🔸 @vanishree_rao 🔸 @kamilgorski from @Tokenguard_io 🔸 @ngweihan_eth from @NethermindEth 🔸 @cryptomattk from

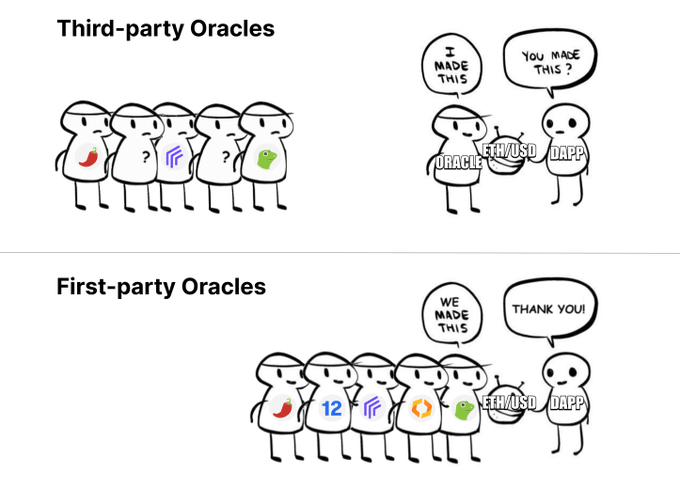

What happened to DeFi? Centralization = falling backwards Let’s move DeFi FORWARD ⏩ API3's Oracle Stack offers: ▲ Permissionless access ▲ Data straight from source ▲ Verifiability onchain ▲ Truly decentralized data ▲ MEV recapture mechanism Built better. ⟁

Join us at @tbc_munich to see how API3 is revolutionizing the oracle landscape with @OEVNetwork. @UgurMersin61 will show why simply bringing data onchain as an oracle isn't enough. API3 is the only oracle to offer a built-in solution for recapturing OEV, allowing dApps to thrive

ℹ️ Important Update: Streamlining Our Data Feeds Effective October 1, we will be discontinuing our equities, forex, and commodities data feeds on the API3 Market. This decision is part of our ongoing effort to optimize our offerings by focusing on high-demand data feeds and

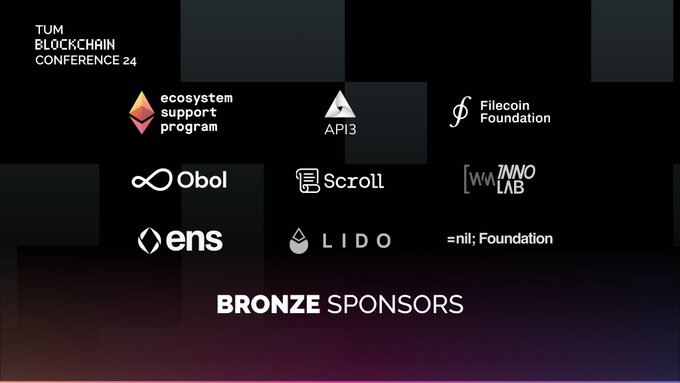

API3 is proud to sponsor @tbc_munich and participate in the Ecosystem track. We'll be showcasing how our next-generation Oracle Stack is transforming DeFi with @OEVNetwork, giving lending protocols a built-in mechanism to recapture oracle extractable value.

📣 𝐁𝐫𝐨𝐧𝐳𝐞 𝐒𝐩𝐨𝐧𝐬𝐨𝐫 𝐀𝐧𝐧𝐨𝐮𝐧𝐜𝐞𝐦𝐞𝐧𝐭 We are excited to announce our Bronze Sponsors for the TUM Blockchain Conference 2024! 🚀 @ethereum (ESP), @API3DAO, @Obol_Collective, @Scroll_ZKP, @wm_gruppe, @ensdomains, @LidoFinance, @nil_foundation, @FilFoundation pic.x.com/VDI8XzXCfH

Most blockchain oracles give you data, but don’t let you verify the source onchain. Defy middlemen. Defy gated access. Defy trusted parties. Defy opaque data. Demand transparency. Challenge the status quo. Let's move DeFi FORWARD ⏩

Simple. Fast. Accessible. Integrating data into your smart contracts is easier than ever on the API3 Market. It’s time to upgrade your oracle. market.api3.org

Unlock the power of a next-generation oracle for your smart contracts. Get the data you need, when you need it. And get paid. 🪙 Our guide makes upgrading your oracle a breeze. youtube.com/watch?v=9qtvVg…

We're doubling down on DeFi. crypto.news/api3-launches-…

YeiFinance Launches on Injective EVM with API3 Oracle Integration

**YeiFinance has officially launched on Injective EVM**, integrating API3's first-party oracles with OEV (Oracle Extractable Value) capabilities. - Builders can now access **real-time data feeds** through API3's oracle infrastructure - The integration provides **secure and transparent** data delivery directly from source - API3 served as a **launch partner** for Injective EVM mainnet This deployment enables developers to leverage advanced oracle functionality including OEV capture mechanisms. The partnership represents API3's continued expansion across EVM-compatible networks. Developers can access the data feeds at [market.api3.org/injective](http://market.api3.org/injective).

New DeFi Infrastructure Proposes Single Entity for Chain Money Markets

A new DeFi concept is emerging that could **simplify blockchain infrastructure** by consolidating multiple services into one entity. Currently, blockchain networks must interact separately with: - Lending protocols - Oracle services - Curator networks The proposed solution would allow chains to access **complete money market functionality** through a single provider with aligned incentives. This approach aims to reduce complexity while maintaining the **"skin in the game"** principle - ensuring the service provider has financial stake in successful outcomes. The concept addresses a key pain point in current DeFi architecture where fragmented services can create operational overhead and potential failure points. *Key benefit: Streamlined access to essential DeFi services without sacrificing decentralization principles.*

Morpho's OEV-Boosted Vaults Hit $30M in Deposits

**Morpho's OEV-Boosted Vaults** have reached over **$30 million in deposits**, focusing on sustainable yield generation through blue-chip collateral. Key features: - **Blue-chip collateral only** for reduced risk - **Liquidation incentive recapture** boosts returns - **Real yield** without unsustainable mechanisms The vault emphasizes **principal protection** over high-risk yield farming strategies. Growth from $20M+ in October shows steady adoption of the conservative approach. [Access the vault](https://app.morpho.org/ethereum/vault/0x68Aea7b82Df6CcdF76235D46445Ed83f85F845A3/oev-boosted-usdc)

RLP/USD Oracle Feed Goes Live on API3

**RLP token now has live price feeds** through API3 oracles, providing transparent multi-source pricing across 40+ blockchain networks. **Key details:** - RLP serves as the risk-bearing layer for USR stablecoin - Token holders earn yield by absorbing systemic risk - Available on [API3 Market](https://market.api3.org) This follows the earlier launch of RESOLV/USD feeds in July, expanding Resolv Labs' oracle infrastructure for their DeFi ecosystem.

Morpho Labs and Yearn Finance OEV-Boosted Vault Update

Morpho Labs and Yearn Finance continue their collaboration on OEV (Maximal Extractable Value) recapture through their joint vault initiative. The OEV-Boosted USDC vault has shown significant growth since its launch, surpassing $10M in deposits. Key points: - Partnership focuses on returning value to users - Vault specifically designed for USDC deposits - Plans include expansion to additional markets and chains - Aims to provide sustainable yield opportunities Visit [Morpho's OEV-Boosted Vault](https://app.morpho.org/ethereum/vault/0x68Aea7b82Df6CcdF76235D46445Ed83f85F845A3/oev-boosted-usdc) to learn more.