API3 DAO Discusses Oracle Extractable Value and Its Implications for the DeFi Industry

API3 DAO Discusses Oracle Extractable Value and Its Implications for the DeFi Industry

🔑 MEV Uncovered: Secrets Revealed

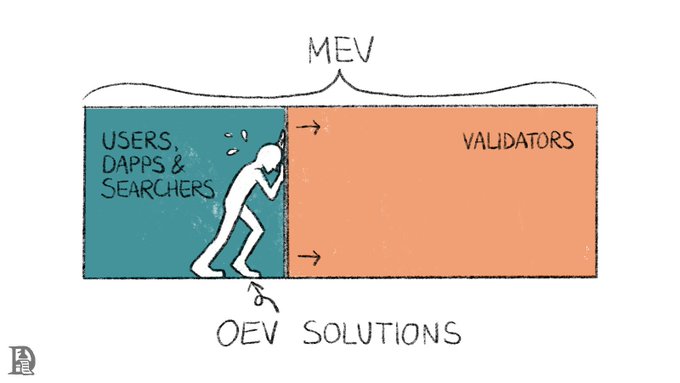

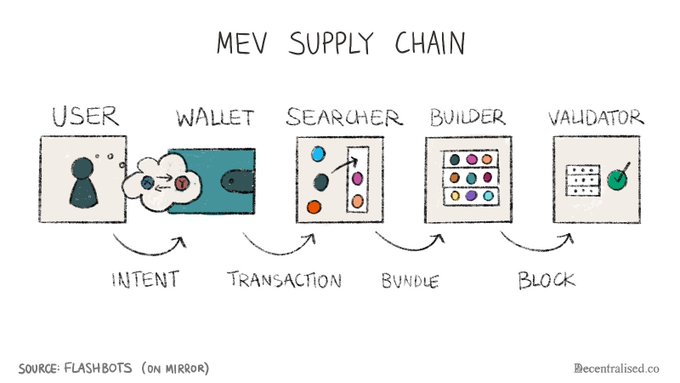

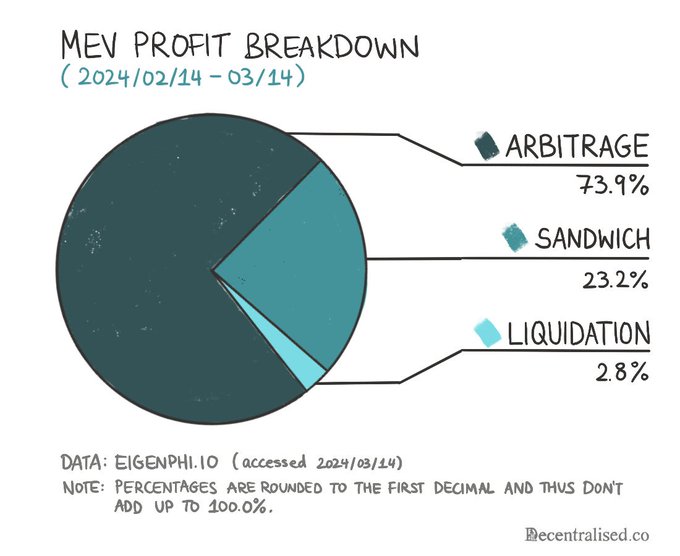

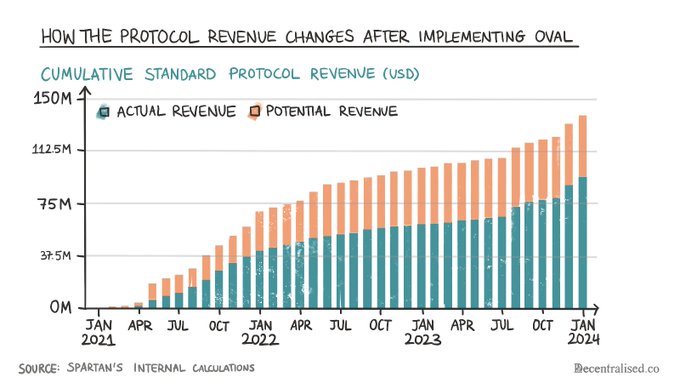

API3 DAO highlighted the issue of Miner Extractable Value (MEV) in decentralized finance, where miners can prioritize transactions for profit maximization. This has led to lending protocols losing revenue from liquidation bonuses paid to searchers. API3 DAO proposed solutions like bundling oracles with searcher auction mechanisms or introducing a delay for liquidators to bid for exclusive liquidation rights. These solutions aim to recapture value lost to MEV and return it to the protocols, improving efficiency and reducing centralization.

On oracle extractable value and what it means for the industry. Each time you do a transaction, there's a complex machinery at play in the background. Between a user signing a transaction and it reaching finality in a block are searchers that compete to have transactions

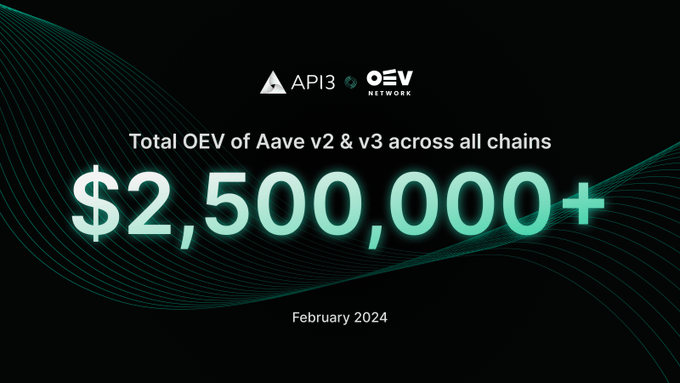

Did you know⁉️ Lending protocols are leaking MILLIONS of dollars each month due to MEV. In February alone, our friends at @aave paid out over $2.5M in liquidation incentives, totaling over $6.5M YTD. It’s time to recapture that value🔥 #OEVNetwork

Let's unlock the secrets of how lending protocols work to discover how OEV Network can reclaim tens of millions of dollars lost to MEV each year. Here's a short thread on everything you need to know about MEV related to liquidations. 🌊🧵

YeiFinance Launches on Injective EVM with API3 Oracle Integration

**YeiFinance has officially launched on Injective EVM**, integrating API3's first-party oracles with OEV (Oracle Extractable Value) capabilities. - Builders can now access **real-time data feeds** through API3's oracle infrastructure - The integration provides **secure and transparent** data delivery directly from source - API3 served as a **launch partner** for Injective EVM mainnet This deployment enables developers to leverage advanced oracle functionality including OEV capture mechanisms. The partnership represents API3's continued expansion across EVM-compatible networks. Developers can access the data feeds at [market.api3.org/injective](http://market.api3.org/injective).

New DeFi Infrastructure Proposes Single Entity for Chain Money Markets

A new DeFi concept is emerging that could **simplify blockchain infrastructure** by consolidating multiple services into one entity. Currently, blockchain networks must interact separately with: - Lending protocols - Oracle services - Curator networks The proposed solution would allow chains to access **complete money market functionality** through a single provider with aligned incentives. This approach aims to reduce complexity while maintaining the **"skin in the game"** principle - ensuring the service provider has financial stake in successful outcomes. The concept addresses a key pain point in current DeFi architecture where fragmented services can create operational overhead and potential failure points. *Key benefit: Streamlined access to essential DeFi services without sacrificing decentralization principles.*

Morpho's OEV-Boosted Vaults Hit $30M in Deposits

**Morpho's OEV-Boosted Vaults** have reached over **$30 million in deposits**, focusing on sustainable yield generation through blue-chip collateral. Key features: - **Blue-chip collateral only** for reduced risk - **Liquidation incentive recapture** boosts returns - **Real yield** without unsustainable mechanisms The vault emphasizes **principal protection** over high-risk yield farming strategies. Growth from $20M+ in October shows steady adoption of the conservative approach. [Access the vault](https://app.morpho.org/ethereum/vault/0x68Aea7b82Df6CcdF76235D46445Ed83f85F845A3/oev-boosted-usdc)

RLP/USD Oracle Feed Goes Live on API3

**RLP token now has live price feeds** through API3 oracles, providing transparent multi-source pricing across 40+ blockchain networks. **Key details:** - RLP serves as the risk-bearing layer for USR stablecoin - Token holders earn yield by absorbing systemic risk - Available on [API3 Market](https://market.api3.org) This follows the earlier launch of RESOLV/USD feeds in July, expanding Resolv Labs' oracle infrastructure for their DeFi ecosystem.

Morpho Labs and Yearn Finance OEV-Boosted Vault Update

Morpho Labs and Yearn Finance continue their collaboration on OEV (Maximal Extractable Value) recapture through their joint vault initiative. The OEV-Boosted USDC vault has shown significant growth since its launch, surpassing $10M in deposits. Key points: - Partnership focuses on returning value to users - Vault specifically designed for USDC deposits - Plans include expansion to additional markets and chains - Aims to provide sustainable yield opportunities Visit [Morpho's OEV-Boosted Vault](https://app.morpho.org/ethereum/vault/0x68Aea7b82Df6CcdF76235D46445Ed83f85F845A3/oev-boosted-usdc) to learn more.