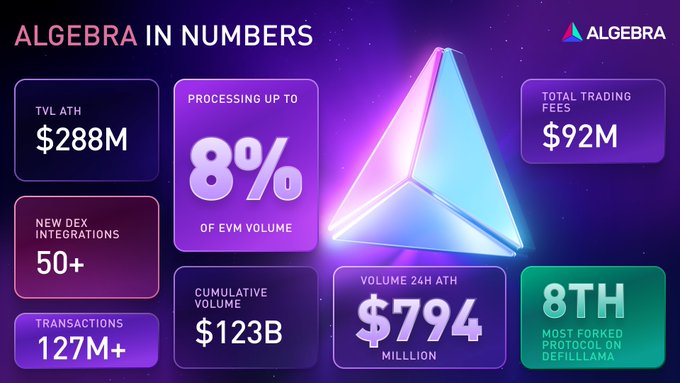

Algebra's decentralized exchange ecosystem continues showing significant growth metrics:

- Processing 8% of total EVM trading volume

- $123B+ in cumulative trading volume

- Reached $794M all-time high daily volume

- $288M total value locked (TVL) at all-time high

- Ranked as 8th most-forked protocol in DeFi

- Over 127M transactions across integrated DEXes

- Now powers 50+ DEXes across multiple chains

This represents substantial growth from earlier in March when the ecosystem supported 40+ DEXes with a TVL of $291M.

The Algebra ecosystem is expanding fast! 🤖 🔈 Processing up to 8% of all EVM volume 💪 $123B+ in cumulative trading volume 😋 ATH daily volume: $794M 🫗 $288M TVL ATH 🦙 8th most-forked protocol in DeFi 💱 127M+ transactions across all DEXes 🧩 Powering 50+ DEXes across the

Algebra V4 Enables Compliant RWA Trading on DEXes

Real-world assets (RWAs) on Ethereum have surpassed $9 billion, with more growth expected. However, most decentralized exchanges lack the infrastructure to handle RWAs due to missing KYC, whitelists, and compliance features. **Algebra's Solution:** - V4 plugins enable permissioned access at the pool level - Supports whitelists, blacklists, and compliance-ready pools - Provides flexible AMM infrastructure for regulated assets The technology is already operational on [Rooster Protocol](https://roosterprotocol.com), the official RWA liquidity hub on Plume Network. Read more: [Algebra + RWA: Building the Next Layer of DeFi Liquidity](https://medium.com/@crypto_algebra/algebra-rwa-building-the-next-layer-of-defi-liquidity-29bc1a18f4b4)

Algebra Introduces Modular Concentrated Liquidity AMMs

Algebra is launching a new approach to automated market makers with modular concentrated liquidity pools (CLAMMs). **Key Features:** - Customizable concentrated liquidity mechanics - Future-proof AMM architecture - Builds on Algebra's existing adaptive fees and built-in farming This evolution follows their previous reCLAMMs innovation, which introduced "set and forget" functionality to reduce the need for constant position management. The modular design allows developers to adapt the AMM infrastructure to different blockchain environments while maintaining concentrated liquidity benefits. Algebra continues expanding its multi-chain DEX protocol beyond its Polygon Network origins.

Algebra Finance Opens Applications for Custom DEX Infrastructure Development

**Algebra Finance is actively seeking projects interested in building decentralized exchange infrastructure.** The platform, known for its concentrated liquidity AMM technology on Polygon, is offering to help teams build DEXs tailored to specific blockchain networks. **Key features of Algebra's infrastructure include:** - Adaptive fee mechanisms - Built-in farming capabilities - Support for deflationary tokens Interested projects can apply through their [application form](http://algebra.finance/form).

🍊 Satsuma DEX Launches on Citrea Bitcoin Layer 2 Mainnet

**Satsuma DEX is now live on Citrea's mainnet**, marking a significant milestone for Bitcoin Layer 2 infrastructure. **Key features include:** - Built on Algebra Integral's concentrated liquidity AMM (CLAMM) architecture - Low-fee trading through efficient core design - Modular V4 plugin system for extensibility - veModel tokenomics for yield generation The launch enables users to **swap assets and earn yield** within the growing Bitcoin L2 ecosystem. Satsuma leverages Algebra's proven technology, which powers concentrated liquidity mechanisms across multiple chains. This deployment follows months of development since the initial announcement in June 2025, bringing advanced DeFi functionality to Bitcoin-based infrastructure through Citrea's Layer 2 solution.

NestExchange Achieves 1.88x TVL-to-Volume Ratio on Hyperliquid

**NestExchange demonstrates exceptional capital efficiency** with $8.33M in 24-hour trading volume against just $4.44M in total value locked (TVL) - a ratio of 1.88x. **Key metrics:** - 24h volume: $8.33M - TVL: $4.44M - Platform: Hyperliquid - Technology: Powered by Algebra This performance indicates strong trading activity relative to liquidity depth, suggesting efficient capital utilization on the decentralized exchange. The high volume-to-TVL ratio reflects active market participation and effective liquidity management through Algebra's concentrated liquidity technology. Algebra continues expanding its DEX infrastructure across multiple chains, having processed $166B in total volume and supporting over 50 decentralized exchanges.