Decentralized exchanges are set to integrate AI-powered liquidity management features, marking a significant shift in DeFi automation.

- AI agents will help manage liquidity positions automatically

- Users can automate stablecoin yield strategies

- Integration with multiple DEXs for limit and sell orders

- Chat-like interface for wallet monitoring and control

This development follows the broader trend of AI integration in crypto wallets and DeFi applications. The technology aims to simplify complex DeFi operations and improve user experience through intelligent automation.

Expected launch: 2025

What if your liquidity could be managed by an AI agent? Coming to a DEX near you.

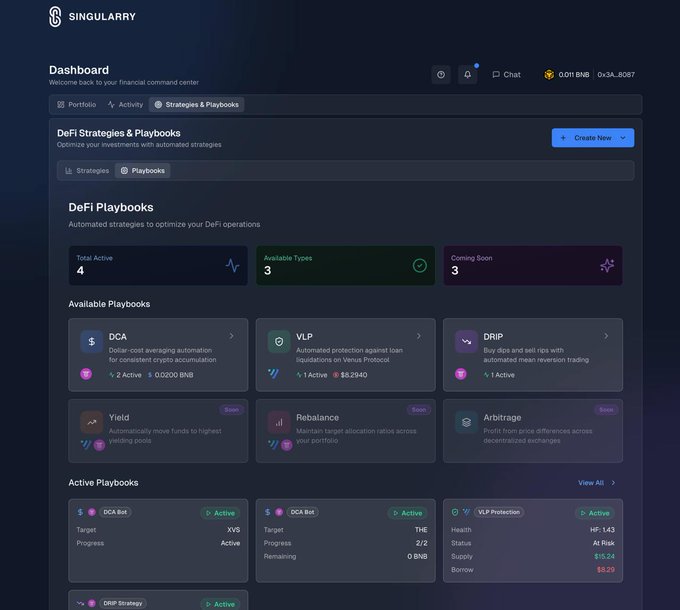

🚀 Discover Playbooks – Automated DeFi Strategies by Singularry DeFi offers endless ways to earn money – from yield farming to arbitrage and everything in between. But let’s be honest: finding the right strategy can be complicated. And even if you figure it out, managing it day

Thena Launches veTHE Automation Powered by Chainlink

Thena introduces veTHE Automation, a new feature powered by Chainlink Keepers that automates key holder tasks: - Auto re-locks to maintain voting power - Auto claim rebase - Auto vote on pools The system runs on smart contracts with Chainlink Keepers handling background operations. Each action costs approximately 0.002 LINK (~$0.03) due to reduced BNB gas fees. The service is audited by Hacken and can be activated in under a minute through the veTHE lock interface. Users need only maintain a small LINK balance for fees. Join the community: [Discord](http://discord.gg/thena)

Caila AI Launches on THENA with $3,000 Voting Incentives

Caila AI expands its presence beyond Binance Alpha by launching on THENA's platform. The project introduces a CA/BNB pool with $3,000 in voting incentives. Key points: - V3,3 pool implementation - $THE rewards activation scheduled with next Epoch change - Similar to AITECH's successful launch pattern from early 2024 This follows a trend of AI projects leveraging DeFi platforms for growth, as seen with AITECH's previous Binance Alpha integration and THENA pool launch. *Participants can earn rewards through staking and voting mechanisms.* [Join the pool on THENA](https://thena.fi)

Carbon DeFi Introduces Customizable Liquidity Ranges for Higher Yields

Carbon DeFi has enhanced its concentrated liquidity features, allowing users to adjust position ranges beyond the default 5% setting. - Users can now fine-tune their liquidity positions for potentially higher yields - The platform offers auto-compounding functionality - More control means increased earning potential for skilled liquidity providers *Key benefit*: Tighter ranges may result in improved yields for active managers. **Note**: As with all DeFi protocols, higher potential returns come with increased risks.

V3.3 Launch Sees Strong ETH/BNB Pool Growth

The new V3.3 protocol has launched successfully with the ETH/BNB pool already exceeding previous liquidity levels, securing over $4M in staked assets. Key developments: - Gas fees reduced by 10x on BNB Chain - Trading volume reached $260M in 24 hours - First pool launched with USDT/USD1 pair - Strong adoption of concentrated liquidity features The platform is now seeking community input for new trading pairs to add to the ecosystem. Users can suggest preferred trading pairs for potential inclusion in future updates. *Want to participate?* Share your preferred trading pair suggestions in the comments.