First CDK OP Stack Deployment with Native Agglayer Integration Goes Live

First CDK OP Stack Deployment with Native Agglayer Integration Goes Live

🚀 OP Stack Without Limits

The first CDK OP Stack with native Agglayer integration has been successfully deployed. This implementation offers:

- Performance of 60-100+ Mgas/s (~4,700+ peak TPS)

- ZK-powered security with pessimistic proofs

- No Superchain tax or seven-day delays

- Native interoperability with Agglayer

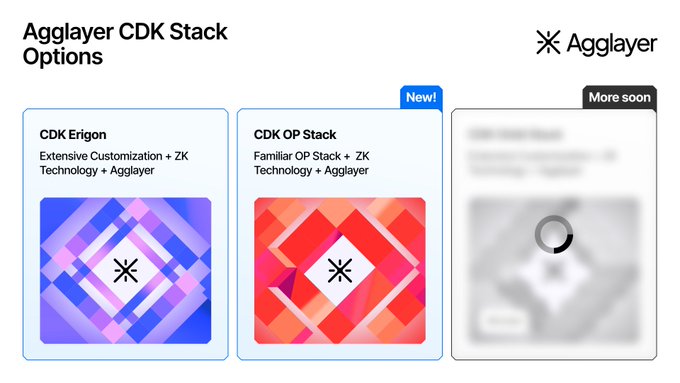

Two stack options are now available: 1. CDK-opgeth by @conduitxyz: Familiar OP Stack with ZK enhancements 2. CDK-erigon by @gateway_eth: 90% reduced storage and custom gas tokens

Future releases will include full execution proofs via SP1 zkVM with Polygon Plonky3.

📣 CDK goes multistack 📣 Aggregating web3 means meeting builders where they are – with more freedom and fewer limitations. We're thrilled to announce the newest addition to Agglayer: the CDK OP Stack configuration, with native Agglayer interop. A new way to build OP Stack

The first CDK OP Stack deployed with native @Agglayer integration. 📨 Get in touch with @conduitxyz to start your Agglayer CDK journey: conduitxyz.typeform.com/to/CrvgqEeA

Shoutout to @conduitxyz for powering the first Agglayer CDK OP Stack rollup, @katana ▪️ G2 sequencer integration = low latency, high throughput ▪️ CDK customizations for vaultbridge + crosschain UX ▪️ Full-stack support from testnet to mainnet

Run your stack, your config, your way. @Agglayer connects it all. Best way to start? Agglayer CDK.

Do you need to conform to a standard stack to connect crosschain?

And with Agglayer CDK, you can now build with OP Stack

I’ve been saying it since last december when I sat down with @therollupco

Polygon Powers 24/7 Borderless Payment Infrastructure

Polygon is enabling a new payment infrastructure with several key features: - **Faster refunds** for improved transaction processing - **Borderless settlement** removing geographic payment barriers - **24/7 always-on rails** ensuring continuous operation This builds on Polygon's Q2 update from August 2025, which highlighted their focus on fast, low-cost, and borderless payment solutions. The infrastructure aims to provide reliable, round-the-clock payment processing without traditional banking hour limitations.

Polygon Powers USDC Tax Refunds at Italian Airports During 2026 Winter Olympics

**Polygon is enabling instant stablecoin tax refunds at major Italian airports during the 2026 Winter Olympics.** Starting this month, international shoppers can claim tax refunds in USDC on Polygon at Milan, Rome, and Venice airports. The service is powered by Global Blue Group and Shift4. **Key Details:** - Instant refunds paid in USDC stablecoin - Available at three major Italian airports - Timed with 2026 Winter Olympics - Built on Polygon network This follows Polygon's October 2025 integration with [DeCard](https://polygon.technology/blog/decard-unlocks-stablecoin-payments-for-150m-merchants-globally-powered-by-polygon), which enabled USDC and USDT payments to 150M+ merchants worldwide. The airport refund system represents a practical application of stablecoin infrastructure for everyday financial services.

Dyadnum Launches First Native WhatsApp DeFi Trading Bot on Polygon

**Dyadnum**, the world's first native WhatsApp trading bot, has launched on **Polygon**. **Key Features:** - Integrates DeFi trading directly into WhatsApp messaging platform - Leverages Polygon's fast transaction speeds and low costs - Simplifies decentralized finance access for mainstream users **Why It Matters:** By embedding DeFi functionality into WhatsApp—one of the world's most widely used messaging apps—Dyadnum significantly expands the potential user base for decentralized trading beyond traditional crypto platforms.

Polygon Joins Enterprise Ethereum Alliance to Build Institutional Payment Rails

Polygon has joined the **Enterprise Ethereum Alliance** alongside Nethermind and Ethena to advance institutional payment infrastructure. Through its **Open Money Stack**, Polygon aims to create global payment rails that bridge traditional financial systems with blockchain networks. The collaboration will focus on three key areas: - Global settlement infrastructure - Merchant payment access - Compliant payment rails This move builds on Polygon's growing position in the payments sector. The network has become a leading chain for **x402 payments** and agentic commerce, where autonomous agents handle real-world transactions. Companies like Toku already use Polygon for stablecoin payroll across 100+ countries, integrating with existing HR systems like ADP and Workday. The partnership positions Polygon to serve as infrastructure for institutional money movement, targeting the $50T global payroll market currently constrained by legacy banking systems.

Stablecoin Activity Reaches New Heights Across Multiple Platforms

Last week saw significant stablecoin activity across multiple metrics: **Transfer Volume** - 94M stablecoin transfers recorded, marking the highest among all chains - USDC supply reached $1.49B, setting another daily all-time high **Platform Performance** - Tazapay processed $687M in monthly volume, establishing a new record - Polymarket recorded $1.7B in trading volume, its second-highest week on record **International Movement** - $195M in international stablecoins transferred - Australian Dollar stablecoin (AUDF) led with $76M in volume These figures demonstrate continued growth in stablecoin adoption across payment platforms, prediction markets, and cross-border transactions.