Aerodrome Finance Hits $300 Billion All-Time Volume Milestone

Aerodrome Finance Hits $300 Billion All-Time Volume Milestone

✈️ Mach 1 Volume

Aerodrome Finance reaches major milestone with all-time volume surpassing $300 billion.

Acceleration timeline shows impressive growth:

- First $100 billion took 15 months to achieve

- Next $200 billion completed in just 10 months

- Represents a tripling of volume in less than a year

Recent performance highlights:

- Processing $11,574 in volume per second over 24 hours

- Capturing 70% more volume than next-best DEX on Base

- Distributed $35M+ to voters in past 30 days

Context from previous milestones:

- $200 billion milestone reached in May 2025

- $100 billion milestone achieved after 1.3 years

- Shows consistent acceleration in trading activity

The DEX continues building momentum as Base's central liquidity hub, with volume growth outpacing previous expansion rates significantly.

Epoch 110 Recap ✈️ Aerodrome's record-breaking year continued as volumes jumped nearly ~$1B from the previous week. Here are the numbers: 📈 $5.6B+ in total volume 🗳️ $3.5M+ distributed in voting rewards 💱 $3.8M+ in swap fees

All-Time Volume Surges Past $300 Billion✈️ It took 15 months for Aerodrome to reach its first $100 billion in volume... It only took 10 months to triple it. Burners on, we're going Mach 1.

$100 Billion in Volume 🛫 Aerodrome has hit a massive milestone: $100 billion in cumulative trading volume. As the liquidity engine of @base, Aerodrome balances the needs of protocols, traders, LPs, and voters to grow the ecosystem together. 🔵

Epoch 109 Recap ✈️ Aerodrome swap fees reached the $150M mark this year as epoch 109 came to a close. Here are the numbers 👇 📈 $4.7B+ in total volume 🗳️ $3.8M+ distributed in voting rewards 💱 $3.8M+ in swap fees 🔵 50%+ of all DEX volume on Base

Highlights From The Last Week 👇 • Aerodrome volumes break ATHs • $AERO joins the @Grayscale DeFi Fund • Aerodrome distributes $35M to voters • Launch on Aerodrome. Reach millions. • The Community Launch is back ✈️

Aerodrome distributed $35M+ in revenue to voters the last 30 days. That's over $1M per day—more earnings than the next 4 major chains... combined. Each week, 100% of protocol revenue is distributed to $veAERO voters. Aerodrome—built different.

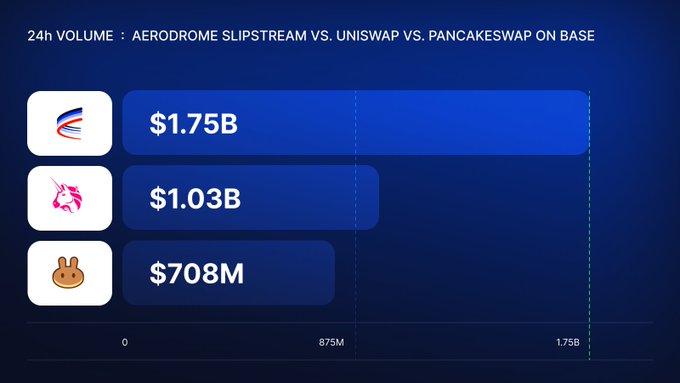

Aerodrome Volume Hits Highest Levels Ever ✈️ In the last 24 hours, Aerodrome volume reached $1.75B—capturing 70% more volume than the next best DEX on @base. Job's not done.

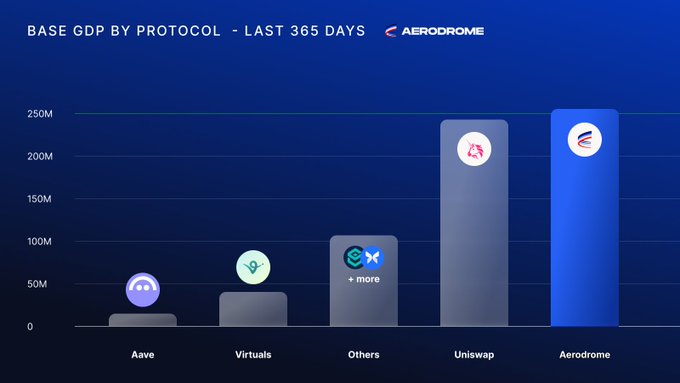

Aerodrome: The Economic Engine of Base In the last year, Aerodrome contributed over $250M to Chain GDP—accounting for more than 30% of the @base economy while surpassing all other protocols onchain. And we're just getting started ✈️

In the last 24 hours, Aerodrome has captured $11,574 in volume...per second. In other words, $1 Billion ✈️

The first Community Launch made Aerodrome the #1 revenue DeFi protocol in its debut. ...maybe it's time for Round 2.

🛬 kVCM Token Launches

**kVCM token has officially launched on Aerodrome**, joining the Base ecosystem's central liquidity hub. **Key Details:** - Available for swapping and liquidity provision - Paired with **WETH and USDC** - Emissions are now live with incentives incoming - Represents KlimaDAO's entry into the Aerodrome ecosystem **Recent Context:** This follows similar launches including RECALL (Oct 15) and PHI (Oct 10), showing continued growth in Aerodrome's token ecosystem. **What This Means:** Traders can now access kVCM through Aerodrome's AMM, while liquidity providers can earn from the active emissions program.

✈️ Aerodrome LP Rewards Hit 966% on Base

**Aerodrome Slipstream** delivers strong LP rewards on Base network: - **WETH-ORDER**: ~966% APY leads the pack - **cbBTC-ZEN**: ~698% returns available - **WETH-SEND**: ~439% yield opportunity - **USDC pairs** showing solid 267-430% returns Rewards have **stabilized** compared to previous days when some pools exceeded 1,000%. The **cbBTC-ZEN** pair maintains consistent high yields across multiple days. *Base ecosystem* continues attracting liquidity with competitive incentives across major token pairs.

✈️ Flight School Removes 15% Cap on New Lock Bonuses

**Flight School has lifted its earning cap for new participants.** Previously, new locks were limited to earning a maximum of **15% of a class's total bonus**. This restriction has now been completely removed. **Key changes:** - New locks can now receive **any amount** of the total class bonus - Participants must still qualify to earn rewards - Change applies to all future Flight School classes This update significantly increases earning potential for new Flight School participants who meet qualification requirements.

Aerodrome PGF Launches Smart Buyback System, Locks $400k AERO

**Aerodrome's Public Goods Fund introduces automated buyback strategy** The PGF has launched a programmatic buyback model that adjusts token purchases based on market conditions. This approach concentrates resources during optimal buying opportunities rather than fixed schedules. **Key features:** - Market-responsive deployment strategy - All acquired tokens are locked as veAERO - Increases PGF's long-term voting power - First buyback completed: $400k worth of AERO tokens **Strategic impact** The locked tokens compound the PGF's governance influence while supporting Base ecosystem growth. Since launch, the PGF has bootstrapped critical liquidity pools and maintained 1.5M AERO in locked positions. This systematic approach replaces ad-hoc buybacks with data-driven timing, potentially maximizing the fund's token accumulation efficiency.