Aerodrome Finance Breaks Volume Records in Epoch 63

Aerodrome Finance Breaks Volume Records in Epoch 63

🚀 $7.6B - Did They Really?

Aerodrome Finance achieved unprecedented growth in Epoch 63:

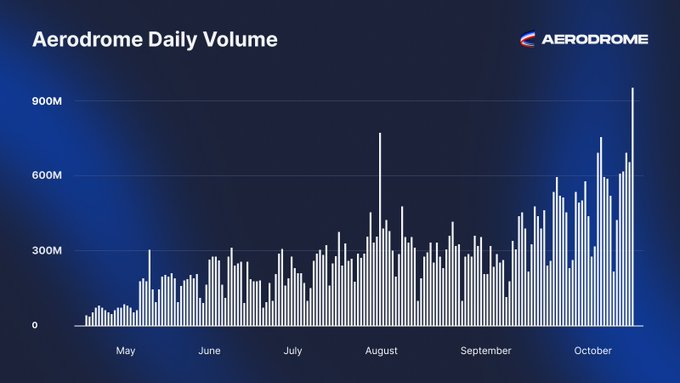

- Record-Breaking Volume: $7.6 billion traded over 7 days

- Daily Average: Over $1 billion in daily trading volume

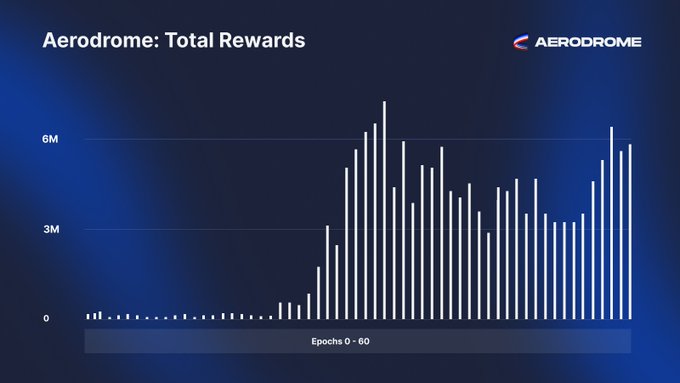

- New Rewards Record: $7.712 million in Total Rewards distributed to veAERO voters

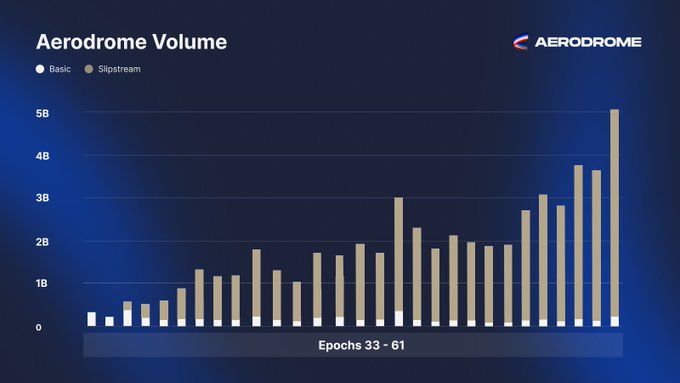

This marks significant growth from previous records, with Epoch 61 reaching $5.07 billion and Epoch 62 hitting $4.9 billion in volume.

The platform continues to demonstrate strong momentum in Base's DeFi ecosystem.

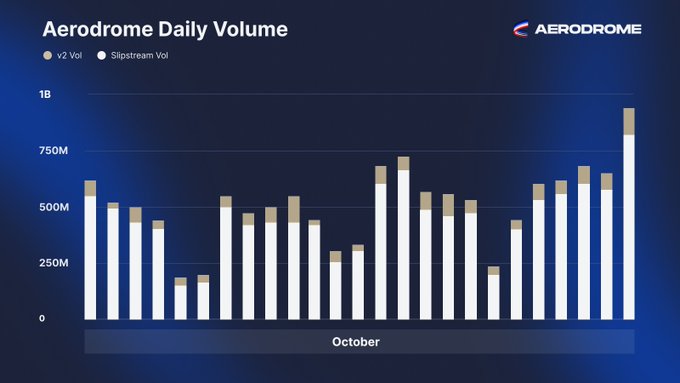

ETH volume on @base is soaring 🛫 Yesterday, @dexscreener reported that the WETH - USDC pool had the highest on-chain volume, nearly matching the combined volume of the next two highest pools. Additionally, it was Aerodrome's second-highest volume day ever, reaching $811.6

cbBTC Volume Dominance ✈️ Paired with USDC and WETH, cbBTC holds the top spot for onchain BTC pool volume, doubling the volume of the next highest pool. Consistently, @base remains the leading chain for trading major tokens.

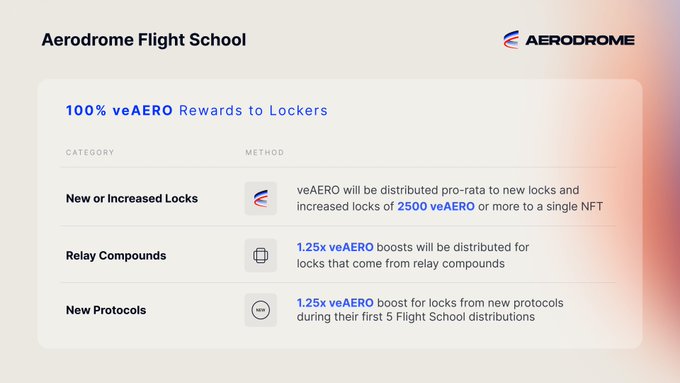

Flight School Class 15 Wraps Up 👨🏽✈️ 1,950,000 veAERO were distributed via Flight School for Class 15 participants. Congrats if you were one of the 239 wallets that received a record 49% bonus for AERO locks. Flight School Class 16 is ongoing for the next 3 epochs. Join us

Flight School Changes 👨✈️ The first 10 classes of Flight School bought back and distributed over 27m veAERO. After the program's success attracting incentives and volume, we are adjusting the program to provide significant veAERO boosts for AERO lockers. Details below 👇

Aerodrome's Volume Ascent ✈️ Aerodrome's volume trajectory has shown continuous growth since Slipstream concentrated liquidity was launched. An all-time high volume of $926 million was set on October 25th. Aerodrome is the liquidity and volume leader on @base. 🔵

Voting Incentive Multiplier Update ✈️ In the last epoch, protocols that incentivized on Aerodrome experienced a 1.85x multiplier in LP rewards for every $veAERO voting incentive. Aerodrome is the most capital efficient DEX for protocols to build deep liquidity in DeFi.

Trade @SeiNetwork on Aerodrome ✈️ Thanks to @UniversalAsset_, $uSEI is now paired with $WETH and available for LPs, with $AERO incentives already flowing. Aerodrome aims to provide the best onchain pool for $SEI LP rewards and trade execution.

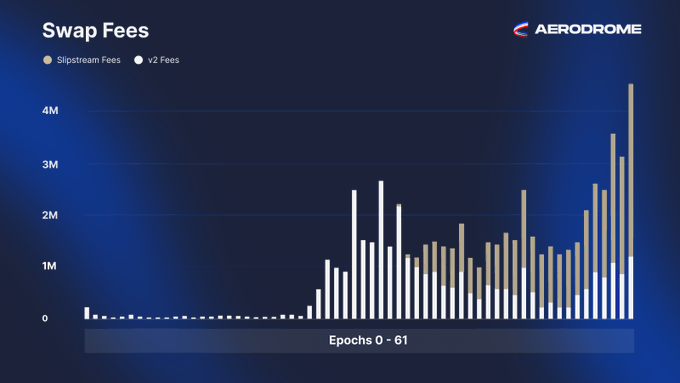

Swap Fees Rising 🛫 Aerodrome has broken another record, collecting $4.535 million in fees during this period. 100% of swap fees are distributed to veAERO voters. Aerodrome aims to attract coins from all ecosystems, positioning @base as the one-stop shop for trading.

New Universal Asset Launch ✈️ Trade @Aptos on Aerodrome. Courtesy of @UniversalAsset_, $uAPT is now paired with $WETH and available for LPs, with AERO incentives already flowing. @base, @UniversalAsset_ and Aerodrome provide a seamless UX to trade nearly everything on @base.

Total Rewards Ticking Up ✈️ Aerodrome's Total Rewards (fees + incentives) are on the rise. In just 14 months, $167.3 million of Total Rewards have been distributed to veAERO voters. Epoch 61 is on track to distribute another $6 million+ in rewards.🗳️

$1 Million Swap Fees for WETH - USDC 🛫 During Epoch 61, Aerodrome's WETH-USDC pool achieved nearly $2.5 billion in volume, generating over $1 million in swap fees. It's the highest volume pool onchain per @dexscreener, making Aerodrome the best place for trading majors. 🔵

Aerodrome Volume Goes Supersonic 🛫 Epoch 61 shattered the volume record, reaching $5.07 billion, with Slipstream accounting for 93%. A total of $6.1 million in Total Rewards (fees + incentives) was distributed to veAERO voters.

Volume Record Shattered 🛫 @base activity went supersonic as Aerodrome smashed its previous volume record by 15%. October 25th hit $926m in volume, with Slipstream accounting for 94% of the total volume. Only a matter of time before a $1b volume day.

Metaswaps Approaches Q2 Launch with Capital-Efficient Cross-Chain Solution

Aerodrome Finance is developing **Metaswaps**, a new cross-chain swap solution targeting a Q2 launch. The system aims to eliminate the need for dedicated liquidity pools or operator networks. **Key features:** - Reduced swap costs through improved capital efficiency - Support for major stablecoins and frequently bridged assets - Access to the deepest available liquidity pools across chains - Expanded coverage for various token types and swap sizes The approach represents a shift from traditional bridge architectures that require separate liquidity and operators. By tapping into existing deep pools, Metaswaps seeks to offer better pricing and availability for cross-chain transactions. More technical details about the implementation will be shared as the Q2 launch approaches.

Aero Tests Metaswaps for Unified Cross-Chain Trading

Aero is testing its new **Metaswaps** feature this week, aiming to consolidate swapping, bridging, and cross-chain aggregation into a single interface. **Key Features Being Tested:** - Support for multiple stablecoins - Native ETH bridging capabilities - Cross-chain trade execution without dedicated liquidity or operator networks The development builds on Aero's modular architecture, designed to be scalable across EVM chains at zero marginal cost. The protocol emphasizes interoperability through its Metalane technology, which abstracts away Layer 2 fragmentation. **Technical Approach:** - Real-time onchain protocol with no centralized dependencies - Seamless upgradeability without user migration - Plug-and-play composability for builders with RPC access The Metaswaps testing represents a step toward Aero's goal of unifying the EVM experience by simplifying cross-chain operations for users.

Aerodrome Slipstream Offers High LP Rewards on Base Network

Aerodrome Finance has announced liquidity provider rewards for January 29, 2026, on the Base network. **Top Performing Pairs:** - USDC-CLAWD: ~15,201% APR - USDC-FUN: ~4,909% APR - WETH-CLANKER: ~904% APR - WETH-BNKR: ~845% APR - WETH-TIBBIR: ~348% APR - cbBTC-cbETH: ~101% APR These rates represent the current rewards available through Aerodrome's Slipstream concentrated liquidity pools. Historical data shows fluctuating rates across different token pairs, with USDC-CLAWD maintaining consistently high returns over recent days. Liquidity providers can deposit assets into these pools to earn the advertised rates.

Aerodrome Adds EMBER Token Pools for AERO Emissions

**EMBER joins Aerodrome's liquidity program** Aerodrome Finance has enabled AERO emissions for EMBER token pools paired with WETH and USDC. The integration brings EMBER into Aerodrome's liquidity incentive system on Base. **Recent additions to the platform:** - SURGE (WETH & USDC pools) - January 28 - CLAWD (USDC pool) - January 27 - ACU, ELSA, and PORTAL (USDC pools) - January 23 These tokens can now receive AERO emissions through Aerodrome's vote-lock governance model, where NFT holders vote to distribute emissions to liquidity pools.

USDai Migrates Protocol Assets to Aerodrome on Base

USDai has moved its protocol-owned assets to Aerodrome Finance on Base, staking the liquidity to earn emissions. **Key Details:** - Protocol assets now deployed on Aerodrome's AMM - Staked liquidity generates emission rewards - Contributes to top trading pools by volume on Base - Users can swap and provide liquidity for $USDai **Why Aerodrome?** The platform allows protocols to earn rewards on their liquidity while supporting high-volume pools on Base network. This follows a pattern of protocols migrating to Aerodrome to optimize liquidity management and earn additional yield through the platform's incentive system.