Aave PT sUSDe Cap Reached, High Fixed APY Available via FiRM

Aave PT sUSDe Cap Reached, High Fixed APY Available via FiRM

🔥 Fixed Rates Just Got Real

The Principal Token (PT) sUSDe cap on Aave has been fully utilized, reaching $2B with only $0.99 remaining. Through FiRM, users can now access:

- Fixed rate yields up to 33%+ net APY (after borrowing costs)

- Immediate access with no waiting period

- Up to 11.7x leverage capabilities

The PT-sUSDe-25SEP25 pool on FiRM previously offered yields up to 42.51% net of fixed borrow costs. Earlier this month, $1M in DOLA was added to support these operations.

Key Features:

- Fixed rates eliminate variable rate uncertainty

- Leveraged positions available

- Backed by @pendle_fi and @ethena_labs

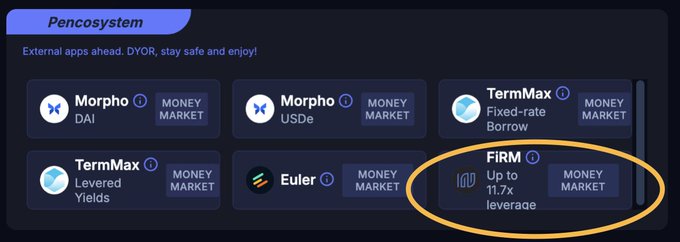

Scroll through the @pendle_fi "Pencosystem" and see a familiar face. FiRM is here. Fixed rates. 11.7x leverage. Don’t sleep.

💥 The PT sUSDe cap is slammed shut on @aave . $2B in, $0.99 left. FiRM lets you lock in up to 33%+ net APY (after fixed rate borrow costs) now. No waiting. No variable rate insomnia. No mercy. @pendle_fi @ethena

FiRM Lets You Sell Unused Borrowing Capacity for Profit

**Early loan repayment = instant savings** When you repay a FiRM loan early, you immediately stop burning DBR tokens. The unused borrowing capacity sitting in your wallet becomes a tradable asset. **Negative interest rates are possible** If DBR price rises during your loan term, you can sell your remaining balance on the secondary market. In some cases, this profit can exceed your borrowing costs—resulting in a negative effective interest rate. **Key mechanics:** - Unused DBR doesn't decay until you borrow - Buy DBR when rates are low, use it when rates spike - Execute on-chain interest rate arbitrage - No need to actually take a loan to profit from rate movements [Learn more about FiRM](https://inverse.finance)

🦃 Thanksgiving Yield Feast

**Thanksgiving DeFi Special** Inverse Finance is serving up holiday yields alongside traditional turkey and cranberry sauce. **Key Offering:** - **22.75% net APY** on sUSDS-DOLA pairs - Available through Yearn Finance integration on FiRM - Positioning yield as "the gravy" for your Thanksgiving feast **What This Means:** The timing connects traditional holiday gratitude with DeFi earning opportunities. The sUSDS-DOLA pairing offers competitive returns through Inverse Finance's fixed-rate lending platform. This rate represents current market conditions for stablecoin yield farming strategies during the holiday period.

sDOLA Expands Cross-Chain to Arbitrum, Base, Berachain, and Optimism via Chainlink CCIP

**sDOLA is expanding cross-chain** to multiple networks including Arbitrum, Base, Berachain, and Optimism using Chainlink's Cross-Chain Interoperability Protocol (CCIP). **Key developments:** - 100% organic yield now accessible across multiple chains - First Chainlink CCIP front-end integration live via Interport - Chainlink USD price feeds for DOLA already deployed on Ethereum mainnet and Base **Enhanced infrastructure:** - Oracle support provides additional resilience for DOLA and sDOLA users - Enables sDOLA use as collateral asset across lending protocols - More cross-chain oracle integrations planned for coming weeks This expansion leverages Chainlink's oracle leadership to bring sophisticated DeFi capabilities to users wherever they need them most.

Chainlink USD Price Feeds for DOLA Go Live on Ethereum and Base

**Chainlink USD price feeds for DOLA are now operational** on both Ethereum mainnet and Base network. **Key developments:** - Ethereum mainnet feed addresses lending and curator requests for **sDOLA collateral support** - Base network feed leverages Inverse Finance's extensive liquidity for **sDOLA expansion** - Integration adds **oracle resilience** to DOLA and sDOLA ecosystems **What's next:** - Additional cross-chain expansion planned - More oracle support coming in the following weeks This integration strengthens DOLA's infrastructure by providing reliable price data through Chainlink's established oracle network, enabling broader DeFi integration opportunities.

FiRM Launches wstUSR-DOLA Market with 26.66% Vault Yields

**New lending market now live** on FiRM featuring wstUSR-DOLA pairing through partnership with ResolvLabs. **Key features:** - Underlying vault yield up to **26.66%** - Fixed borrow rate at **6.97%** - Leveraged yields shown net of borrowing costs - Additional points rewards available **Autocompounding options** available through Yearn Finance and Convex Finance integrations. The market combines fixed-rate leverage with double-digit base yields. Users can access detailed information and ask questions through the project's [Discord community](https://discord.gg/bYXrPS786w). *Standard disclaimers apply - do your own research.*