40acres Finance Autocompounder Reaches $2.29M TVL

40acres Finance Autocompounder Reaches $2.29M TVL

🚜 Zero to Millions

40acres Finance's Autocompounder platform has demonstrated significant growth, reaching $2.29M in Total Value Locked (TVL) within its first 30 days of operation. This follows a broader trend of growth for the protocol, which previously recorded a $14M TVL increase in late 2024.

Key metrics:

- 0 to $2.29M TVL in 30 days

- Consistent growth trajectory since 2024

- Strong community participation

The platform continues to maintain steady expansion while focusing on sustainable growth metrics.

Our @40acres_Finance Autocompounder grew from $0 to $2.29M TVL in just 30 days.

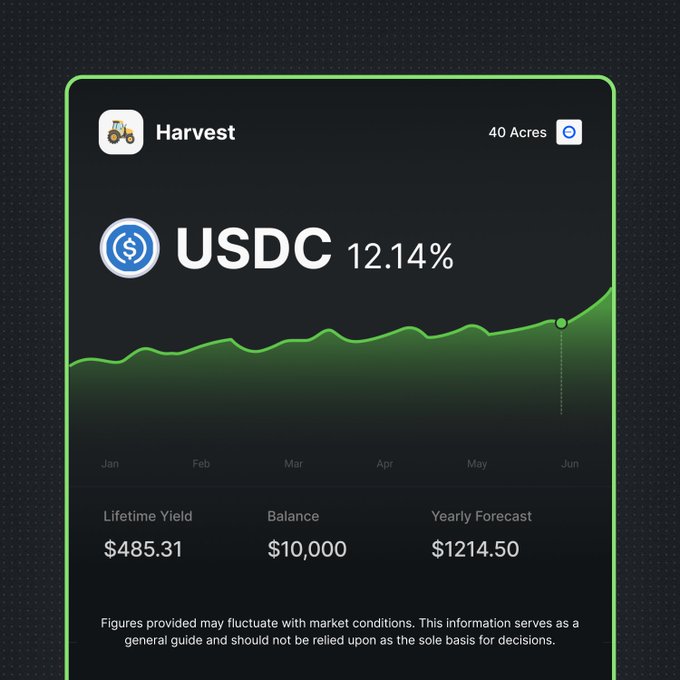

Harvest Finance Autopilot Update: Growing TVL and New Integrations

Harvest Finance's USDC Autopilot on Base network continues to show strong growth, reaching $2.48M TVL with 151 users as of April 29, 2025. The platform currently maintains a 10.01% rate with 100% allocation to MoonwellDeFi. The system leverages 12 active sub-vaults powered by major DeFi protocols: - MorphoLabs - 0xfluid - Aave - Compound Finance - ExtraFi - Moonwell Additionally, two new sub-vaults from Euler Finance and Arcadia Finance are currently in the integration queue. This growth follows the successful launch 5 days ago, which attracted $3.4M from 215 wallets. The Autopilot system automatically rebalances across multiple protocols to optimize yields.

Harvest Finance Advances Next-Gen Automation Vaults

Harvest Finance is developing next-generation automation vaults, showing leading performance metrics on Base and Arbitrum networks. Key developments: - New tracking dashboard in development - Mobile app coming soon - VIRTUAL vault seeing significant TVL growth - Integration with ExtraFi positions These upgrades aim to enhance DeFi position automation and user experience. The platform continues to expand its automated farming capabilities across multiple networks. *Track your yields at app.harvest.finance*

Inactive Strategies Hold Significant Funds

While developing the Leaderboard, Harvest Finance discovered wallets containing substantial amounts in dormant strategies. Some accounts hold five to six-figure sums that are not actively generating yields. - Wallets with $10,000+ found in inactive strategies - Some accounts have $100,000+ in dormant positions - Owners may be unaware of these idle funds This situation presents an opportunity for users to optimize their investments. Harvest encourages account holders to review their positions and consider moving funds to active, high-yielding strategies. **Check your wallet**: You might have forgotten assets earning suboptimal returns. *Take action*: Review your Harvest positions and ensure your funds are working hard for you.

Harvest's cbBTC Strategy Maintains Top Spot on DeFiLlama

Harvest's single-exposure cbBTC strategy, powered by Moonwell DeFi, continues to hold the #1 position on DeFiLlama. This achievement, first reported on October 2nd, remains consistent as of October 15th. - Strategy maintains top ranking for at least 13 days - Powered by Moonwell DeFi markets - Part of Harvest's successful Base network strategies Additionally, Harvest reports significant inflows to their single-exposure EURC and cbETH strategies on the Base network, also utilizing Moonwell DeFi markets. These developments highlight Harvest's ongoing success in providing high-yielding farming strategies across various assets and networks.