Liquity is positioning its V2 protocol and $BOLD stablecoin as a fully decentralized alternative as the stablecoin market splits between regulated commodities and decentralized protocols.

Key Features:

- Ethereum-native with no intermediaries or governance

- Immutable smart contracts

- Borrow $BOLD against ETH and LSTs

- Predictable yield for holders

Recent Performance:

- Successfully processed $1.1M in liquidations

- ETH Stability Pool depositors earned 192.57% APR during recent event

- $BOLD maintained $1 peg throughout volatility

- Multiple yield venues offering 20%+ APR

Yield Opportunities:

- Stability Pools: 8-100%+ APR from liquidations and borrower fees

- LP positions: 13-34.55% APR across Ekubo, Curve, Uniswap

- sBOLD/yBOLD: Auto-compounding options via Pendle and Spectra

Liquity argues the middle ground of "trust me bro" stablecoins with multisigs and opaque yield will be eliminated, leaving only fully regulated and purely decentralized options. Built by the team behind LUSD, which reached $5B TVL over 4+ years with zero governance interference.

volatility brings opportunity. The Liquity ecosystem is offering 20% + APR across multiple low-risk venues on @ethereum. Pick your lane: 🧠 Stable LP yield: LP BOLD/USDC on @EkuboProtocol / @CurveFinance / @Uniswap (13% +) 🧩 LP sBOLD/yBOLD: @pendle_fi / @spectra_finance

Liquity V2 passed another liquidation event with flying colors. ~$300k liquidations processed (mostly in ETH) - ETH SP $BOLD depositors earned ~0.30% ROI on their deposit (110% APR annualized 👀) - BOLD held $1 the entire time. All with immutable smart contracts. It pays to

Want low-risk yield that doesn’t require monitoring every week? Here's how you can earn a steady ~8% APR without constant monitoring on Liquity V2 Liquity's Stability Pools - your DeFi savings accounts👇

BOLD take from @stacy_muur "Ethereum positioning itself as the decentralized financial settlement layer doesn't work if the main stablecoins can be frozen by centralized entities. You can't have censorship-resistant DeFi with censorable money." Read the in-depth piece about

The stablecoin market is splitting in two: ✅ Fully regulated commodities ✅ Purely decentralized protocols Everything else - the 'trust me bro zone' of multisigs and opaque yield - gets cleared out. $BOLD is betting on decentralization winning.

Liquity's CEO calls the middle of the stablecoin market the "trust me bro zone." Michael Svoboda: "You're adding a multisig, a yield source, making it a hedge fund. Risk on risk on risk." Two models will survive: fully regulated commodities and purely decentralized. Everything

A new sBOLD @pendle_fi pool expiring at the end of June is now live. PT enjoyers - lock in a fixed 6.5% APR! YT buyers - get exposure to Liquity forks airdrops LP providers - provide liquidity and earn fees check it out 👇

The first @LiquityProtocol-friendly fork airdrop has already hit, and sBOLD holders have benefited. To celebrate, we're rolling a @pendle_fi pool maturing 25 Jun '26, built for anyone who wants BOLD yield + Liquity "forkenomics" in a clean, tradable format.

The “trust me bro zone” always ends with gates. Liquity V2 is the self-sovereign alternative, the ultimate freedom protocol: Ethereum-native, no intermediaries, and immutable. Borrow $BOLD against ETH on your terms Hold $BOLD to earn predictable yield. Full control, always.

BLOCKFILLS HALTS WITHDRAWALS AMID CRYPTO TURMOIL Susquehanna-backed crypto lender BlockFills has suspended client deposits and withdrawals, citing recent market volatility. The Chicago-based firm, which serves 2,000 institutional clients and handled $60 bn in 2025 trading,

Learn more about BOLD's A- rating: 📄 Full analysis: liquity.org/blog/bold-rece… 🔍 Learn more about Bluechip: bluechip.org/en 💰 Get BOLD: liquity.app/borrow 💱 Buy BOLD: swap.defillama.com The stablecoin that can't be frozen. ⛓️💥

Ethereum needs sovereign crypto dollars - not tokenized fiat strategies with multiple layers of counterparty risk. That @ethereum dollar is $BOLD. Check out our interview on @therollupco 👇

Liquity's CEO calls the middle of the stablecoin market the "trust me bro zone." Michael Svoboda: "You're adding a multisig, a yield source, making it a hedge fund. Risk on risk on risk." Two models will survive: fully regulated commodities and purely decentralized. Everything

34.55% APR on a BOLD / USDC pool in this economy? It’s real - and live on @EkuboProtocol. Ekubo is redirecting Liquity’s PIL to its new V3 'boosted' BOLD/USDC pool. Active (in-range) LPs get boosted swap fees → earn a larger share of fees. link 👇

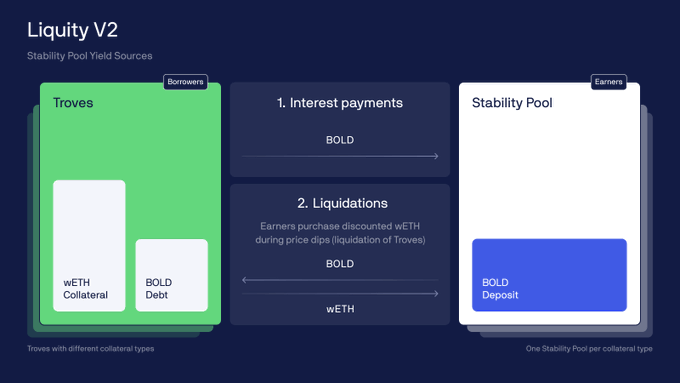

Liquity V2 and $BOLD are different. It passes on 100% of protocol revenues to grow the stablecoin, with a fixed 75% going to the Stability Pools. BOLD Stability Pool = a on-chain savings account generating → Deposit BOLD → Earn from borrower interest (75% of protocol

Built by the team behind LUSD (Liquity V1): → $5B peak TVL → 4+ years live → Zero governance interference Crypto native stablecoins are needed. BOLD is testament to that.

In our new podcast with @Bluechip_org, we dive into stablecoin risk trade-offs: → How BOLD earned A- and perfect 1.0 scores in decentralization → Why bank-backed ≠ crypto-backed (even at same rating) → What "can't be frozen" actually means technically

Rails Launches Trove Economics Dashboard for Liquity Users

Rails has released a new feature that provides comprehensive insights into Trove economics for Liquity users. **Key Features:** - Detailed breakdown of redemptions and fees - Real-time collateral value tracking - Clear explanations of complex DeFi mechanics The dashboard aims to make Liquity's lending protocol more accessible by visualizing important metrics that affect user positions. This builds on Rails' previous work with Liquity V2 position visualizers. For users managing Troves, this tool offers transparency into the economic factors that impact their collateralized debt positions.

Liquity V2 Offers Lowest DeFi Borrowing Rates at 2% Below Competition

**Liquity V2 enables treasuries to borrow against ETH without selling assets** The protocol allows users to set their own fixed interest rates or delegate to rate managers like Summerstone and Bolder Cash. This flexibility has resulted in competitive advantages: - **1-year average rates**: Lowest in DeFi, 2% below competitors - **Loan-to-value ratio**: Up to 91% with ETH collateral - **90-day performance**: Cheapest loans in the market The platform offers two borrowing options: users can either set custom fixed rates or use automated rate management services. This approach gives treasuries runway flexibility without liquidating ETH holdings. [Learn more about Liquity V2](https://www.liquity.org/frontend-v2)

Liquity Allocates 20,000 BOLD Weekly to LP Rewards

Liquity is distributing **20,000 BOLD tokens weekly** to liquidity providers on Curve and Uniswap. **Key Details:** - Curve Finance LPs earning ~11% APR - Uniswap LPs earning ~12% APR - Rewards paid in addition to standard swap fees - LQTY stakers can direct rewards to specific pools **How It Works:** The rewards program aims to incentivize liquidity for BOLD, Liquity's V2 stablecoin. LQTY token stakers have governance rights to allocate these rewards toward pools they believe will drive protocol growth or where they're providing liquidity themselves. These yields represent sustainable, ongoing rewards rather than temporary promotional rates.

BOLD Stability Pool Depositors Earn Yield from Four Liquidation Events Since October

**Liquity V2's Stability Pool continues to generate returns for BOLD depositors through liquidation events.** Since October 10th, the protocol has processed **four liquidation events**, each creating yield spikes for Stability Pool participants. While these events are unpredictable in timing, they consistently occur and provide reliable returns. **Recent performance highlights:** - ~$300k in liquidations processed (primarily ETH) - ETH SP depositors earned approximately **0.30% ROI** per event - Annualized returns reached **110% APR** during liquidations - BOLD maintained its $1 peg throughout all events The protocol operates entirely through **immutable smart contracts**, providing trustless yield generation. Depositors earn returns by providing liquidity that absorbs liquidated collateral when borrowers' positions fall below required thresholds. While liquidation timing remains uncertain, the consistent pattern demonstrates a proven mechanism for BOLD holders to earn passive income through Stability Pool deposits.